Student debt collections are back in the spotlight as the U.S. Department of Education prepares to resume recovery actions on May 5, marking a significant change for millions of borrowers who have fallen behind on their payments. This move reintroduces the potential for involuntary collections, including federal student loan default repercussions such as wage garnishment and tax refund offsets. The Office of Federal Student Aid has emphasized that these measures are part of a broader initiative to enforce loan repayment strictly, which may echo harshly through borrowers’ finances. With the collection processes reinstated, the stakes raise for those grappling with unpaid student loans, highlighting the urgency for individuals to understand their rights and options. Knowing how to navigate this landscape is crucial, particularly in a time when the financial implications of students’ loan defaults can be overwhelming.

As student loan repayment resumes, the return of aggressive debt recovery methods like involuntary collections raises alarm among borrowers. This system involves direct actions taken by the federal government to recover overdue payments, which can sometimes include actions such as wage deductions and tax refund withholdings. Such strategies are critical as they address the financial strain many graduates feel, particularly those who are already struggling due to recent economic challenges. While the Office of Federal Student Aid aims to clarify these processes, borrowers might find themselves at risk without adequate understanding of their rights. In this evolving landscape of educational financing, knowledge about loan discharge options and the timeline for collections is essential to ensure individuals can respond appropriately.

Understanding Student Debt Collections

Student debt collections have long been a contentious issue in the United States, with the Department of Education playing a significant role. Resuming collections means that borrowers who have fallen behind on their student loan payments will face serious consequences, including involuntary collections. This system is a response to the alarming rise in federal student loan defaults, which can lead to severe financial repercussions for millions of borrowers.

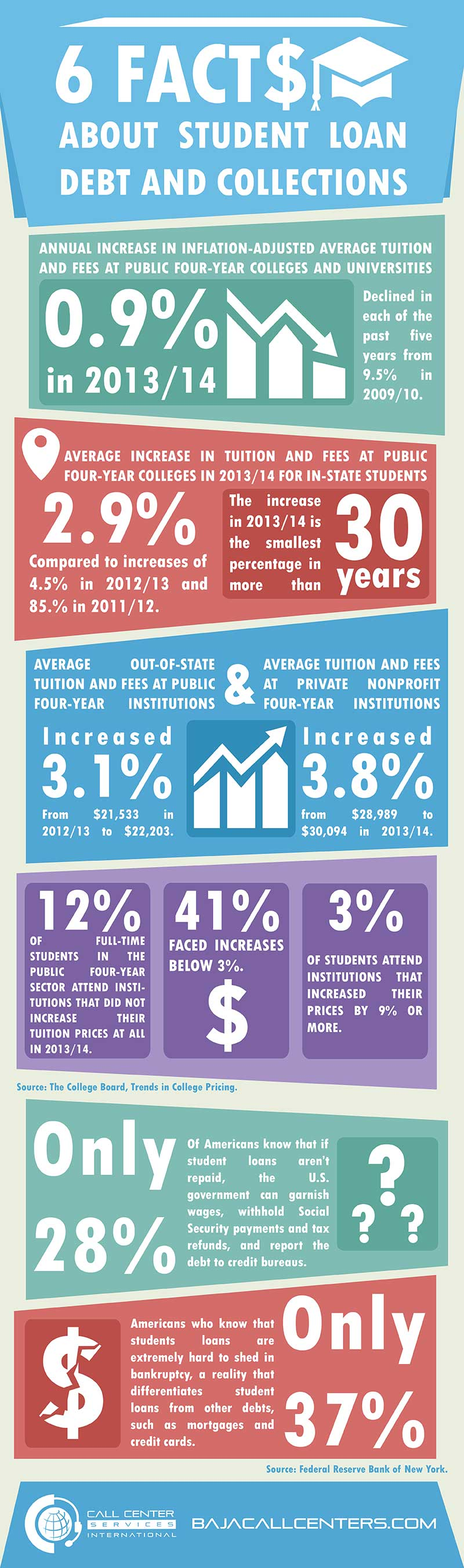

As student debt collections resume, many borrowers are finding themselves unprepared for the aggressive actions they may face. The last five years saw a pause on collections due to the pandemic, creating a false sense of security for those who had not kept up with payments. With the resumption of collections, many may be shocked to learn about the extensive measures available to the government, such as wage garnishment and the siphoning of federal tax refunds to recoup defaulted loans.

Frequently Asked Questions

What does it mean for student loans to fall into involuntary collections?

Involuntary collections occur when borrowers default on their federal student loans, leading to automatic penalties imposed by the government. This may include wage garnishment, where up to 15% of a borrower’s disposable income is withheld, tax refund offsets, and seizure of Social Security benefits. Understanding the consequences of defaulting on federal loans is crucial to managing your student debt effectively.

What steps can I take to prevent federal student loan default and involuntary collections?

To avoid federal student loan default and subsequent involuntary collections, borrowers should stay proactive. This includes enrolling in an income-driven repayment plan to adjust monthly payments based on income, communicating with your loan servicer, and exploring options for loan rehabilitation or consolidation. It is essential to address payment challenges before they escalate into default.

How can wage garnishment affect borrowers in student debt collections?

Wage garnishment affects borrowers by allowing employers to withhold up to 15% of disposable income directly to repay defaulted federal student loans. This penalty can severely impact financial stability, as it reduces the borrower’s take-home pay, making it essential for borrowers to manage their loans and communicate with lenders to avoid default.

What is the role of the Department of Education in student debt collections?

The Department of Education oversees the collection of federal student loans and enforces involuntary collections for borrowers who default. They provide notice to borrowers, allowing them an opportunity to repay their loans before imposing penalties, and they can initiate wage garnishment and tax refund withholdings to recover owed amounts.

What should I do if I receive a collection notice for my federal student loan?

If you receive a collection notice for your federal student loan, it is crucial to act quickly. Contact your loan servicer to discuss your options, which could include entering a repayment plan, loan rehabilitation, or consolidation. Understanding your rights and available remedies can prevent involuntary collections and further financial distress.

What are the consequences of federal student loan default regarding involuntary collections?

The consequences of federal student loan default include involuntary collections, which can result in wage garnishment, tax refund offsets, and the loss of certain government benefits. Borrowers may also experience a significant drop in credit scores and ongoing financial strain if they do not take action to rectify their loan status.

Are there alternatives to involuntary collections for borrowers struggling with student debt?

Yes, borrowers struggling with student debt have several alternatives to involuntary collections. These include income-driven repayment plans that adjust payments according to income, applying for loan consolidation, and seeking rehabilitation of their loans. Finding the right solution can prevent default and help maintain financial stability.

What does student loan discharge mean in the context of involuntary collections?

Student loan discharge refers to the cancellation of a borrower’s obligation to repay federal student loans under specific circumstances. It can prevent involuntary collections, but obtaining a discharge typically requires meeting strict eligibility criteria, such as proving total and permanent disability or demonstrating undue hardship in bankruptcy.

| Key Point | Details |

|---|---|

| Resumption of Collections | The U.S. Department of Education will resume student debt collections on May 5, after a five-year pause. |

| Involuntary Collections | This includes actions like wage garnishment and withholding tax refunds for borrowers who default on loans. |

| Consequence of Default | Defaults can trigger wage garnishments, with the government able to withhold up to 15% of federal salaries and 100% of tax refunds. |

| Expectation for Borrowers | Borrowers are advised to be proactive and explore repayment options to avoid penalties. |

| Current Situation | As of October 2023, borrowers can adapt to repayments with a one-year ‘on-ramp’ period where delinquencies won’t be reported. |

Summary

Student debt collections are set to resume, marking a significant shift in the U.S. Department of Education’s approach to borrowers who have fallen behind. Starting May 5, borrowers may face harsh consequences if they do not act swiftly. Understanding the implications of involuntary collections, it’s crucial for students and parents to engage proactively with their loan servicers and explore available repayment options to navigate this challenging landscape. With many borrowers already in financial distress, clarity and timely action are key to mitigating the adverse effects of renewed debt collections.