The U.S. fiscal state is undergoing significant changes that could redefine its trajectory for years to come. As Americans file their taxes, they are confronted with a fiscal landscape reshaped by dramatic policy shifts and ongoing debates about taxation. The history of income tax in the U.S. reflects a shift towards progressive taxation, aiming to address issues of American economic inequality. Recent discussions around tariffs and taxes suggest a potential pivot that could alter how the nation finances its priorities. In a time when fiscal policies are crucial for sustaining social programs and economic stability, understanding the evolving U.S. tax policy is essential.

The current financial condition of the United States is marked by critical transformations that merit attention. As citizens navigate the complexities of their tax obligations, they find themselves amidst a changing landscape influenced by both historical context and contemporary policies. Notably, the evolution of income tax regulations highlights a move towards a more equitable system designed to combat rising American economic disparities. Recent developments surrounding tariffs suggest a shift in the funding mechanisms for governmental needs, reflecting broader discussions on revenue sources. As these fiscal dynamics unfold, they underscore the importance of progressive taxation in shaping a more balanced economic future.

The Evolution of U.S. Tax Policy

The evolution of U.S. tax policy has been marked by substantial shifts in response to economic needs and political pressures throughout history. From its inception, the income tax was designed to address growing economic disparities and fund a burgeoning federal government. Before the late 19th century, the primary sources of revenue relied heavily on regressive tariffs that disproportionately affected lower-income Americans. This reliance on tariffs not only limited the government’s capacity for investment in public goods but also heightened the emergence of economic inequality. The push for the income tax was a pivotal moment in American fiscal history, arising from the need to create a more equitable system that could fund essential services and reduce reliance on unequal tariffs and excise taxes on goods like tobacco and alcohol.

The introduction of the graduated income tax through the 16th Amendment in 1913 marked a significant paradigm shift in U.S. tax policy. It aimed to create a more progressive network of taxation where higher earners contributed a larger portion of their income, theoretically allowing the government to redistribute wealth in a way that would help mitigate glaring inequalities. Over the decades, progressive taxation became a cornerstone of federal policy, underpinning various social welfare programs and infrastructure projects. Ultimately, U.S. tax policy evolved not only to address immediate financial needs but also to lay the groundwork for what would become the modern fiscal state, capable of financing ambitious initiatives during both world wars and the Great Depression.

Impacts of Progressive Taxation on Economic Inequality

Progressive taxation has been critical in addressing economic inequality in the United States, especially in the context of post-war prosperity. The mid-20th century saw a flourishing middle class, bolstered by a strong income tax system that allowed for substantial public investment in infrastructure, education, and social security. As wealth and income became more evenly distributed during this era, the tax system played a vital role in lifting many Americans out of poverty and reducing the concentration of wealth. Economic historians note that this period was characterized by the most significant reduction in income disparity over the last century, largely attributed to the progressive nature of the income tax alongside robust government spending.

However, this achievement in income equality has increasingly come under threat, particularly with the rise of tax cuts and regressive tax policies in recent decades. Critics argue that recent tax reform efforts have disproportionately benefited wealthier Americans while straining federal resources needed for poverty alleviation and healthcare. The resurgence of tariffs and other forms of taxation that hit the middle and lower classes harder could again create a two-tiered economic landscape, leading to increased American economic inequality. The challenge moving forward lies in balancing fiscal policy to ensure that taxation serves to support societal equity rather than exacerbate wealth disparities.

The Role of Tariffs and Taxes in U.S. Fiscal State

Tariffs historically played a pivotal role in shaping the U.S. fiscal landscape, initially aimed at protecting domestic industries from foreign competition. However, as the economy evolved, tariffs became less about revenue acquisition and more about political maneuvering. This often took the form of regulatory protections that benefited specific industrial sectors at the expense of broader economic health. The contemporary administration’s pervasive use of tariffs as a tool for economic warfare indicates a significant shift back toward protectionist policies, igniting debates about the efficacy and fairness of such measures in modern American fiscal policy. Tariffs can indeed raise prices for consumers, leading to potential backlash against the intended beneficiaries of these economic protections.

This contemporary focus on tariffs raises questions about the long-term sustainability of such a fiscal approach. If tariffs replace more equitable tax structures like income tax, there could be serious repercussions for economic stability and social equity. The challenge is to harmonize tariff duties with a comprehensive tax policy that ensures equitable participation in funding public goods. Failing to do so risks undermining the financial foundation that supports vital government programs and amplifying concerns over economic inequality in America.

Consequences of Current U.S. Fiscal State

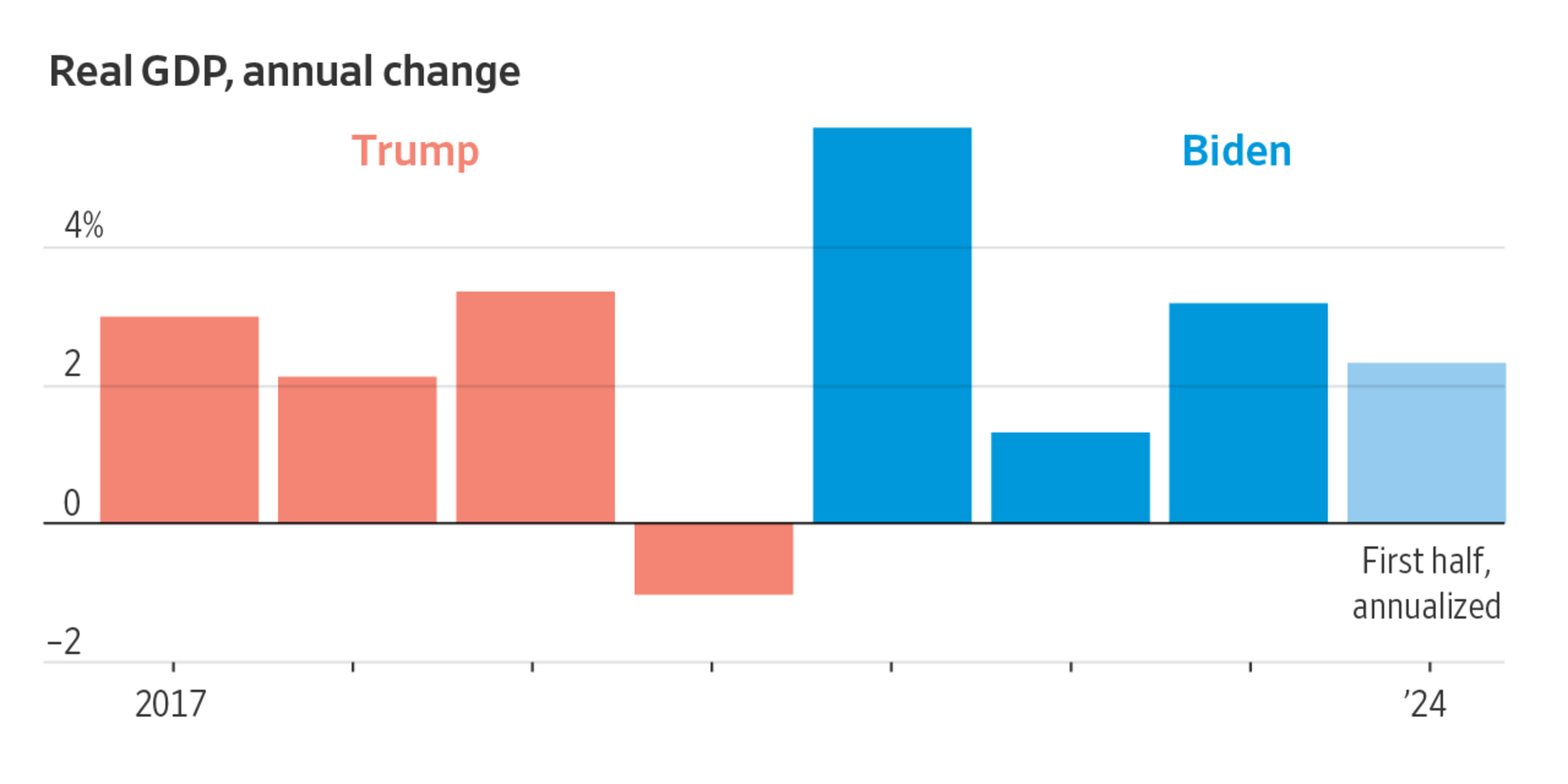

The current U.S. fiscal state is at a crossroads with implications for generations to come. With the administration’s push to bolster tariffs and erode income tax structures, the financial stability that has supported American initiatives faces significant risks. The recent tax cuts proposed under the Trump administration, if extended, threaten to exacerbate existing fiscal vulnerabilities by rolling back essential revenue streams. The anticipated deficit surge could hinder the government’s capacity to fund vital programs that support the elderly, low-income families, and other vulnerable groups. Furthermore, the shrinking of IRS resources could result in decreased tax compliance and lost revenues, ultimately stalling crucial public investment.

The concern surrounding the fiscal state is not merely academic; it carries profound implications for American democracy. Without a strong financial backbone grounded in equitable tax policies, the government may struggle to fulfill its obligations to its citizens. The potential consequences—returning to a fiscal landscape reminiscent of the late 19th century characterized by rampant inequality and disenfranchised populations—are alarming. As such, it is imperative to navigate the complex interplay of taxation, tariffs, and social policy to ensure that the foundational principles of equality and democracy remain safeguarded amidst current political and economic upheaval.

Reflections on American Economic Inequality

American economic inequality has deep roots influenced by various fiscal policies, cultural attitudes, and legislative decisions. Despite several measures aimed at reducing disparities, the U.S. remains one of the countries with the highest levels of wealth concentration among its citizens. The historic shift towards a more progressive tax structure during the 20th century marked a positive turn in addressing these inequalities, but recent trends suggest a troubling regression as fiscal policies shift toward favoritism and elitism. As the dialogue around tax reform continues, it is essential to reflect on the foundational principles of American democracy, which advocate for equal opportunity and shared prosperity.

The intensity of the recent fiscal changes accentuates the ongoing debate about the role of government in managing economic inequality. Critics argue that current tax cuts disproportionately privilege the wealthy while burdening the working class. Continued advocacy for reforms aimed at enhancing the progressive nature of the tax system is essential to revamping policies that historically reduced inequality. Addressing American economic inequality requires not just a reevaluation of tax structures but also a commitment to fostering an inclusive economic model that benefits all citizens, ensuring that the strides made in equity are not lost in the current political and economic climate.

The Future of American Fiscal Policy

Looking ahead, the future of American fiscal policy hinges on the ability of lawmakers to embrace a more progressive taxation framework. The potential for such reforms to bolster economic stability is significant, especially in addressing issues of rising wealth inequality and diminished government resources. Any substantive shifts toward reestablishing a robust income tax system could serve as an effective countermeasure to the concentrated wealth and power of the upper class. Engaging in proactive discussions around taxation and its role in facilitating equitable growth will be vital in shaping a fiscal policy that can withstand the challenges of the 21st century.

Moreover, as American society grows increasingly diverse and complex, there is a need for a fiscal policy that resonates with the changing demographic landscape while promoting social justice. This necessitates comprehensive tax reforms that prioritize equity and sustainability. Strategies such as implementing higher taxes on the wealthiest individuals and corporations, while providing relief to lower income brackets, must be central to any future fiscal discussions. By committing to innovative and inclusive tax policies, the U.S. can pave the way for a robust fiscal state that fosters equality, promotes prosperity, and reinforces the democratic values upon which the nation was built.

The Political Landscape Surrounding U.S. Taxes and Tariffs

The political landscape surrounding U.S. taxes and tariffs is often contentious, reflecting the broader ideological divides in the nation. The shifting focus from income taxes to tariffs indicates a reorientation in how the government perceives its fiscal responsibilities. High-profile political figures have begun advocating for a tariff-based system, which they argue can drive domestic production while reducing the reliance on income taxes. However, such policies are met with skepticism as they tend to disproportionately affect lower and middle-income earners, who may struggle with increased prices for goods as tariffs reshape market dynamics.

The intertwining of taxes and tariffs within the political discourse highlights a crucial juncture for the American fiscal state. Engaging citizens in discussions about the implications of these policies could culminate in widespread advocacy for a more balanced tax system that emphasizes fairness. The challenge remains to articulate a vision for fiscal policy that transcends partisan interests and prioritizes the long-term economic welfare of the nation. Collaboration among policymakers, economists, and the general populace will be essential in navigating these complexities and fostering a sustainable and equitable fiscal future.

Reforming the IRS: A Call for Transparency and Efficiency

The ongoing discussions surrounding the reform of the IRS symbolize the need for greater transparency and efficiency within the federal tax structure. As recent policy changes threaten to diminish the agency’s capacity to enforce tax laws, the potential implications are profound. A well-functioning IRS is crucial for maintaining the integrity of the tax system, ensuring that all citizens contribute fairly to the collective budget. Efforts to debilitate the agency only serve to exacerbate existing inequalities, as wealthier individuals and corporations may evade their fiscal responsibilities without adequate oversight.

Moving forward, there is a critical need to reform the IRS not just for transparency’s sake but also to ensure that it operates as a fair arbiter in the complicated landscape of taxation. Advocating for increased funding for the agency, alongside initiatives aimed at technology upgrades, can help bolster IRS capabilities to audit, collect, and manage tax revenues efficiently. Ensuring that the tax system is inclusive and equitable demands a robust and empowered IRS that can effectively administer tax regulations and uphold taxpayer rights. Such reforms will be indispensable in fostering confidence in the tax system and enhancing the overall efficiency of the U.S. fiscal state.

The Intersection of Social Policy and Fiscal Stability

The intersection of social policy and fiscal stability is a critical focal point in fostering an equitable and just society. A progressive taxation system is essential for financing social programs that address public needs—from healthcare to education and infrastructure. As the government grapples with budgetary constraints and income disparities widen, the impact of fiscal decisions on social policy becomes increasingly pronounced. Discussions on reforming tax policies to create more robust revenue streams must acknowledge the significant role of social programs in building societal resilience.

Additionally, prioritizing social investment not only strengthens communities but also enhances overall economic productivity. By aligning fiscal strategies with social outcomes, policymakers can create a cycle of growth that invests in human capital and infrastructure. As we envisage the future of the American fiscal state, it is crucial to recognize that the sustainability of fiscal policies is deeply intertwined with their social implications. Moving toward a model that balances fiscal responsibility with social equity will be paramount in shaping a resilient and prosperous nation.

Frequently Asked Questions

What is the significance of the U.S. fiscal state in modern America?

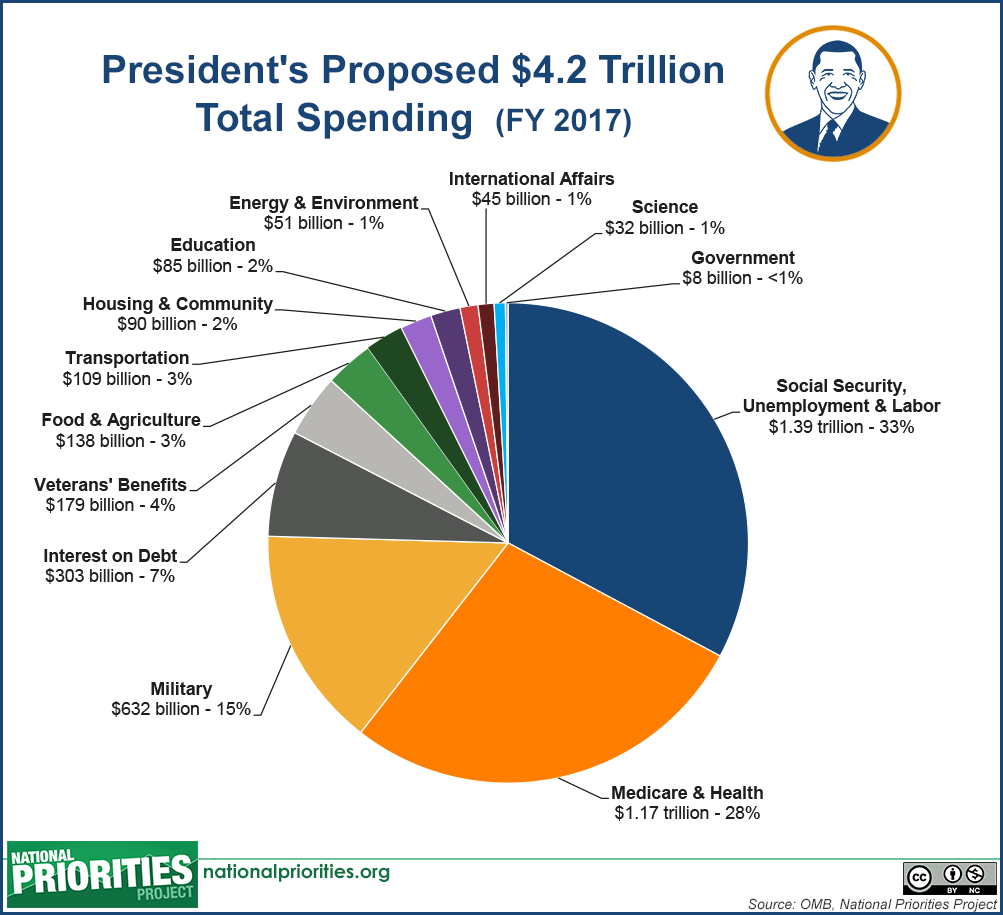

The U.S. fiscal state is crucial as it defines the government’s ability to collect taxes and allocate resources. It plays a key role in funding essential public services, from social safety nets to national defense, illustrating the need for a balanced taxation system that adapts to contemporary economic challenges.

How have income tax history and progressive taxation shaped the U.S. fiscal state?

Income tax history in the U.S. reflects a shift toward progressive taxation, established to address economic inequality and enhance federal revenue. This structure allows wealthier individuals to contribute a larger share, critical for funding government initiatives and stabilizing the fiscal state.

What are the implications of current U.S. tax policy on American economic inequality?

Current U.S. tax policy, influenced by recent legislative changes, poses potential risks to American economic inequality. The reliance on tariffs and tax cuts may exacerbate wealth disparities unless corrective measures in tax structure and revenue collection are implemented to ensure equitable distribution.

How do tariffs and taxes interact within the U.S. fiscal state framework?

In the U.S. fiscal state, tariffs and taxes are interconnected. Tariffs are used as protective measures for domestic industries but can lead to reduced tax revenues if implemented excessively, thus affecting overall government financing and public expenditure capabilities .

What challenges does the U.S. fiscal state face in maintaining democratic equality?

The U.S. fiscal state currently faces challenges such as political pressures influencing tax policy, potential cuts to tax enforcement, and the risk of reverting toward a regressive system, each threatening democratic equality by undermining the capacity to fund public goods and services.

| Key Aspects | Details |

|---|---|

| Historical Context | The American fiscal state began over a century ago with the introduction of income tax to support public goods and services. |

| Importance of Income Tax | Income tax was designed to replace regressive tariffs and ensure a more equitable distribution of the tax burden. |

| Recent Developments | Current government actions are reversing decades of fiscal policy, including cuts to the IRS and shifts towards tariffs. |

| Impact on Inequality | There is a risk of returning to an era of heightened inequality without a strong fiscal framework. |

| Outlook | The ongoing changes may undermine the capacity of the U.S. government to finance necessary public services. |

Summary

The U.S. fiscal state is at a critical juncture, with recent shifts threatening the foundations established over a century ago. The current administration’s strategies, including significant IRS cuts and a renewed focus on tariffs, risk destabilizing a system that has historically supported essential public services and mitigated economic inequality. As the debate continues, it’s crucial to recognize the importance of maintaining a robust fiscal framework to address the pressing needs of American society.