The impact of Trump tariffs on the stock market has become a hot topic as traders navigate through unprecedented volatility. Since President Trump’s announcement of a 10% tariff on imported goods, investors have closely monitored the responses of various stocks, particularly on the S&P 500. The abrupt pause on tariffs prompted a notable surge in the market, but also reignited fears of stock market volatility associated with potential insider trading allegations. As shares of Trump Media and Technology Group soared alongside broader market gains, many speculate about the ethical implications surrounding such movements. With lawmakers scrutinizing the tariff pause effects and trading patterns, the intersection of politics and Wall Street remains a focal point of discussion.

The recent developments surrounding tariffs set forth by the Trump administration have significantly influenced the financial landscape, particularly regarding stock market dynamics. Investors are increasingly concerned about the repercussions these trade policies have had on market fluctuations, such as the sharp ascents and descents of stock valuations. Following a temporary halt on tariffs, the financial community witnessed a dramatic shift, prompting discussions around the ethical ramifications of actions involving Trump’s media companies. Moreover, allegations of market manipulation and insider trading have stirred controversy, raising questions about compliance within the securities market. As the discourse continues to evolve, stakeholders eagerly analyze the interplay between trade policy announcements and stock performance.

The Impact of Trump Tariffs on Stock Market Dynamics

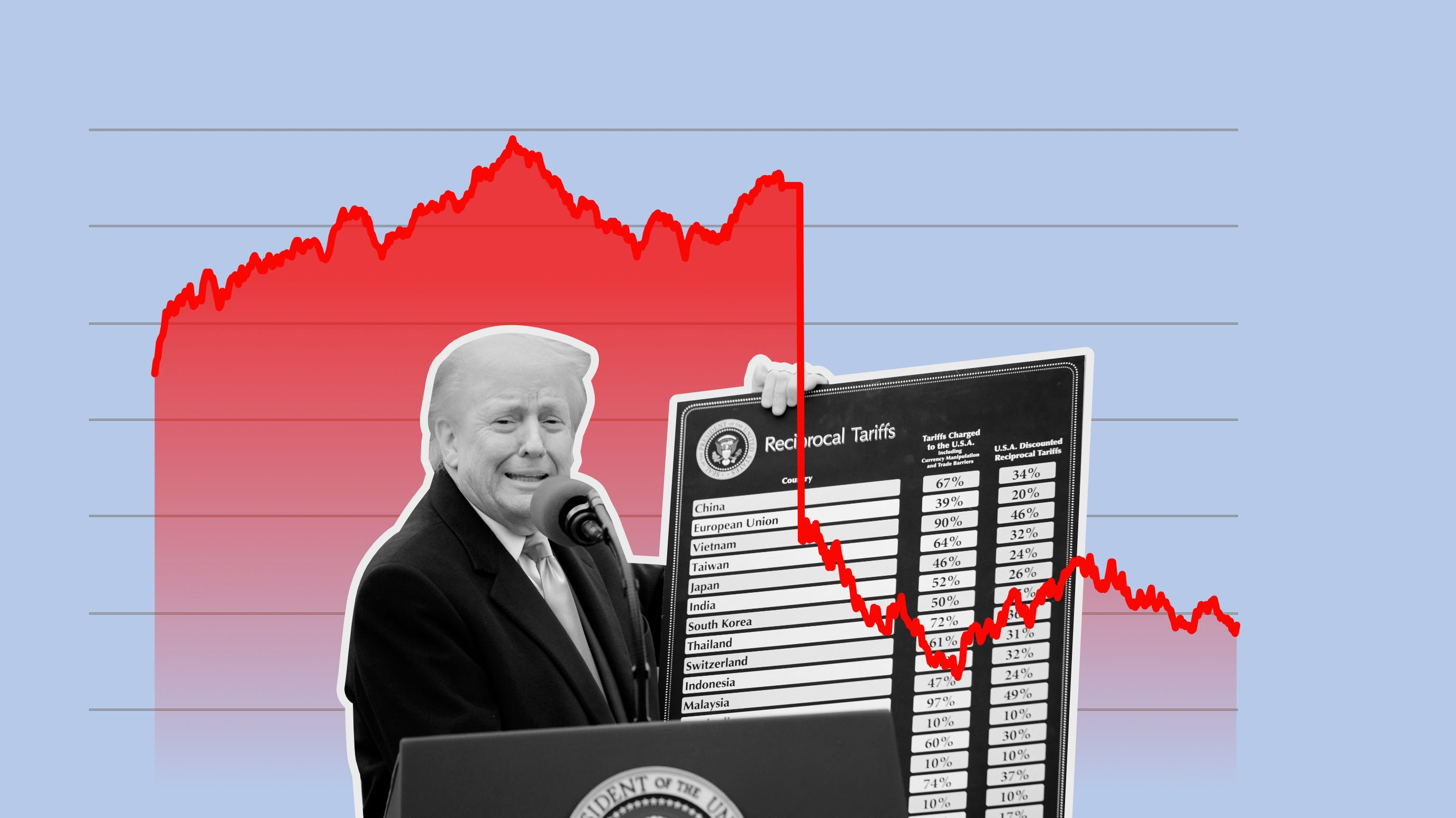

The announcement of President Trump’s 10% tariffs on imported goods has undoubtedly sent ripples through the stock market, triggering significant volatility. Following the implementation of tariffs, investors were taken aback as stock prices fluctuated wildly. The uncertainty surrounding these new tariffs led to a panic response, highlighted by the sudden drop in the Dow, where it plummeted by almost 1,900 points. Market participants were quick to react, weighing the implications of Trump’s actions on future trade relations and overall economic health, which contributed to prevailing fears of possible recession.

However, the subsequent announcement of a 90-day pause on these tariffs temporarily buoyed the market, resulting in an S&P 500 surge of over 9%. This dramatic rebound illustrated the interconnectivity between policy decisions and market reactions, with many speculators eager to capitalize on what seemed like a brief respite from trade tensions. This immediate uptick not only reinstated investor confidence but also raised questions about how long such optimism could last amidst ongoing trade negotiations and legislative maneuvers.

Trump Tariffs and their Effect on S&P 500

When President Trump announced a pause on certain tariffs, the stock market experienced a notable jolt resulting in a recorded surge of the S&P 500 index. Investors interpreted this pause as a sign of stabilizing trade relations, allowing them to feel more secure in their holdings. Often used as a benchmark of overall market performance, this index’s rise reflects investor sentiment that suggests a willingness to invest amidst uncertainty, instigated by the abrupt shift in trade policy. A staggering 9% increase indicated that traders believed the President’s actions could prevent a deeper market downturn.

Yet, this optimism was starkly juxtaposed with immediate volatility following the initial surge, as the very next day saw the S&P 500 drop over 5% amidst growing concerns about ongoing trade policies and their ramifications. This event underscores the volatility inherent in the stock market when significant political and economic decisions are made public. As analysts indicate, although the pause offered a momentary reprieve, the stock market remains sensitive to potential policy shifts that could disrupt this fragile balance.

The Role of Social Media in Market Movements

President Trump’s use of social media, particularly on platforms like Truth Social, has become increasingly influential in shaping market dynamics. His post encouraging investors to buy stocks during a period of turmoil underscores a unique intersection of social media, personal influence, and market reaction. Many were quick to interpret his messages as a call to action, which led to a significant spike in stocks associated with Trump Media and Technology Group, with shares climbing nearly 22% in response to investor enthusiasm fueled by his words.

This raises pertinent questions about the ramifications of public figures affecting market sentiment through non-traditional communication channels. The implications of direct messages from a sitting president can create trust and urgency among retail and institutional investors alike. As the market continues to evolve, the intertwining of leadership communication and stock market performance necessitates careful examination, particularly in how such communications can drive both immediate confidence and subsequent skepticism as seen with the rapid shifts following Trump’s announcements.

Insider Trading Allegations Linked to Trump’s Actions

The collision of Trump’s tariff announcements with allegations of insider trading presents a complex narrative for the stock market. As Senator Adam Schiff urged for an investigation, claiming Trump’s social media post potentially influenced trading behaviors, the implications touch on both ethical and legal concerns. Critics argue that such communications could have provided an unfair advantage to select individuals aware of strategic presidential moves, thus breaching the trust that should underpin stock market operations.

This situation illuminates broader issues of transparency and accountability for public officials who make market-influencing declarations. As experts dissect the layers of these allegations, the focus narrows on determining how and when information was shared amongst parties that may have had knowledge of the tariff reversals before they became public—raising legitimate concerns about the fair play essential to maintaining investor trust in the stock market.

Analyzing Stock Market Volatility Following Tariff Decisions

Stock market volatility is often exacerbated during pivotal economic announcements, as evidenced by the wild fluctuations following Trump’s tariff decisions. Stakeholders in the market often find themselves on edge, reacting to news that could dictate international trade flows and domestic economic stability. The trade war escalated fears of a recession, driving market responses that were rapid and drastic. Investors often resort to risk-averse strategies during such turbulent times, heightening the already fluctuating nature of stock values.

This stark volatility highlights an essential pattern within financial markets: rapid shifts based on perceived instability can lead to significant sell-offs, as evidenced by the Dow’s sharp decline post-announcement. Understanding these trends allows investors to navigate their strategies more effectively, tapping into historical volatility patterns while being cognizant of current political developments and their potential ramifications on trade relations and ultimately, stock performance.

The Influence of Political Decisions on Trump Media Stocks

The interplay between political decisions and stock performance is vividly illustrated in the fluctuations of stocks associated with Trump Media and Technology Group. As Trump navigates the political landscape, including his stance on tariffs, the repercussions can have immediate effects on his company’s financial interests. Trump’s public comments about the market can lead to increased trading volume and a spike in stock value, as observed when shares surged following his announcement regarding tariff pauses.

However, fluctuations reflect more than just market responses to tariff influences; they also reveal underlying investor sentiments towards Trump’s political trajectory. Political allegiances and market together create a tapestry of activity where every announcement can tangibly affect stock values, thus illustrating how closely political environments and financial markets are entwined.

Legislative Scrutiny Following Trade Policies

The ramifications of Trump’s tariff announcements have extended into the legislative sphere, prompting calls for thorough investigations into the potential ethical implications tied to stock market manipulation. Lawmakers have expressed concerns about the timing and execution of Trump’s pauses on tariffs, fearing that the administration might be leveraging policy changes to benefit financially from market fluctuations. This legislative scrutiny aims to ensure accountability and ethical behavior among those in power, especially concerning insider trading allegations.

Calls for disclosure from congressional members regarding stock transactions underscore the need for transparency in political decision-making. The inquiries tackle not only the actions of the President but also aim to prevent any potential conflicts of interest among lawmakers themselves, ensuring that the integrity of financial dealings remains intact. As investigations unfold, the interplay between policy, market strategy, and legal frameworks presents critical conversations concerning fair trading practices.

Expert Opinions on Market Manipulation and Trading Laws

In light of the allegations surrounding insider trading and potential market manipulation, experts emphasize the necessity of scrutinizing the nature of communications made through social media platforms by public figures. Legal scholars argue that such actions could fall into gray areas where distinctions between savvy market strategies and unethical practices must be carefully evaluated. The ambiguity surrounding insider trading laws compounds the challenge, as they do not provide clear boundaries, frequently leaving interpretation open to debate.

Legal experts advocate for a rigorous examination of past actions and communications associated with significant market fluctuations. Through a robust investigative lens, we may delineate between genuine market strategy and irresponsible manipulation, driving necessary reform into how legislative bodies handle potential breaches of trust within stock markets. As public trust wavers, the importance of establishing clear, enforceable standards for traders, particularly those in positions of power, cannot be overstated.

Future Trends in Stock Market and Tariff Policies

Looking ahead, the relationship between stock market performance and tariff policies will be a focal point for investors and policymakers alike. Market participants will remain vigilant, watching for any signals indicating shifts in trade policies that could trigger either positive or negative reactions. The lessons learned from Trump’s tariff announcements will likely shape future market responses and influence how companies hedge against similar outcomes.

Furthermore, commentary from political leaders, especially regarding potential tariffs and international trade agreements, will continue to play an integral role in the broader economic landscape. Understanding these trends can equip investors with the foresight to navigate a marketplace that remains susceptible to sudden shifts, thereby affirming the necessity of maintaining adaptive investment strategies in the face of political uncertainty.

Frequently Asked Questions

How do Trump tariffs impact stock market volatility?

Trump’s tariffs have introduced significant stock market volatility by altering investor confidence, particularly around import taxes and trade dynamics. Initially, the announcement of a baseline 10% tariff on imports led to heightened concern among investors, causing sharp declines. However, the subsequent announcement of a tariff pause contributed to a brief surge in the S&P 500, highlighting the unpredictable nature of market reactions to tariff news.

What are the implications of Trump’s tariffs on Trump media stocks?

Trump’s tariffs and related announcements directly impacted Trump Media stocks. Following Trump’s social media posts endorsing stock purchases amid tariff changes, shares for Trump Media and Technology Group saw a significant spike, indicating a correlation between his tariff announcements and investor behavior towards his media company.

What are the insider trading allegations related to Trump and his tariffs?

Allegations of insider trading emerged following Trump’s social media posts encouraging stock purchases just before announcing a tariff pause. This raised ethical concerns, as critics claim his statements could constitute market manipulation and insider trading, particularly if he provided non-public information to close associates who could trade based on that knowledge.

How did the S&P 500 respond to Trump’s tariff pause?

Upon the announcement of a 90-day pause on most tariffs, the S&P 500 experienced a notable surge, climbing over 9%. This reaction illustrates the market’s sensitivity to trade policy changes and highlights the potential for rapid fluctuations in stock prices based on presidential announcements regarding tariffs.

What are the tariff pause effects on stock market trends?

The tariff pause announced by Trump stabilized the market temporarily, resulting in an immediate boost to stock prices, especially in sectors affected by tariffs. However, subsequent volatility persisted, demonstrating that while such pauses can offer short-term relief, the long-term effects on stock market trends remain uncertain amid ongoing trade tensions.

| Key Events | Stock Market Reactions | Political Reactions | Legal Concerns |

|---|---|---|---|

| Trump announces 10% tariff on imports on April 2, and additional taxes on 60 countries. | S&P 500 surges over 9% after the pause announcement on April 9. | Senator Adam Schiff calls for an investigation into Trump’s social media post. | Concerns raised about possible insider trading related to the tariff pause. |

| Trump raises tariffs on China imports while maintaining the 10% baseline. | Dow drops 1,900 points and S&P falls 5% the day after the initial surge. | Democratic lawmakers demand transparency regarding Trump’s decisions. | Calls for review of communications between Trump and financial institutions. |

| Trump posts on Truth Social suggesting it’s a good time to buy stocks. | Shares of Trump Media Group spike 22% following the announcement. | Concerns raised about the ethical implications of Trump’s posts. | Experts debate whether Trump’s actions constitute market manipulation. |

| Trump claims he deliberated on his tariff pause before announcing. | Investors and analysts express confusion due to market volatility. | Calls to investigate stock trades by Congress members around the announcements. | Legal experts highlight ambiguity in insider trading laws and implications. |

Summary

The impact of Trump tariffs on the stock market has been significant and turbulent, with major fluctuations following his announcements. The initial tariff implementation led to steep market drops, whereas a subsequent pause ignited a brief surge. However, allegations of insider trading and market manipulation have emerged, raising serious ethical and legal questions about Trump’s communications and the timing of his posts regarding stock investments. As the situation unfolds, it’s clear that the ramifications of Trump’s tariffs extend beyond trade policies, affecting both investor sentiment and legislative scrutiny.