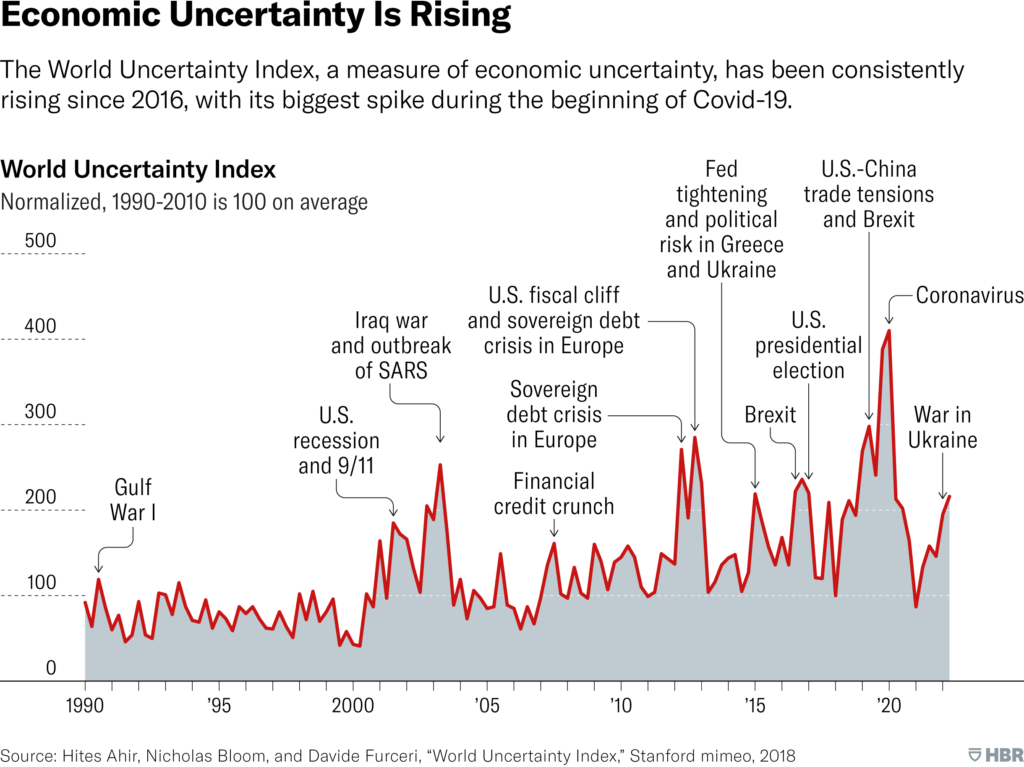

Economic uncertainty is casting a long shadow over the financial landscape, prompting many individuals and businesses to rethink their spending habits. Factors such as fluctuating tariffs and unpredictable government policies have fueled a growing sense of instability, leading to a notable impact of economic uncertainty across various sectors. As people grapple with the potential for a recession risk due to uncertainty, consumer confidence continues to decline, pushing families to delay significant purchases. Businesses are feeling the pinch as well, with many adopting a cautious business response to uncertainty that stifles growth and innovation. In such tumultuous times, navigating the unpredictable economic terrain has become a daunting challenge for everyone.

In today’s fast-evolving economic climate, the shifting sands of financial stability create a palpable sense of trepidation among consumers and enterprises alike. The unpredictable nature of current economic policies and international trade relations has left many questioning the resilience of their fiscal decisions. As skepticism rises, household confidence wanes, and many are experiencing a notable dip in consumer optimism. Companies are adjusting their strategies in the face of market volatility, leading to a decrease in committed expenditures and investments. Amid this backdrop of economic unpredictability, the decision-making process for both individuals and businesses becomes increasingly fraught with challenges.

The Impact of Economic Uncertainty on Spending Decisions

Economic uncertainty has far-reaching effects on consumer spending behavior. In the face of fluctuating markets and unpredictable fiscal policies, households often adopt a wait-and-see approach before committing to significant purchases. Individuals like Renata Kero, for instance, find themselves rethinking prior expenditures, such as hiring landscaping services, driven by a sense of instability in the broader economy. This retrenchment in consumer sentiment frequently corresponds with declines in consumer confidence, which, as reported, fell significantly amid growing apprehensions about job security and future income stability.

Moreover, economic uncertainty not only spurs consumers to delay purchases but can also lead to a notable contraction in overall economic growth. When families hold off on spending due to fears of economic downturns, it results in a ripple effect that affects businesses reliant on consumer spending. This caution can diminish GDP growth, triggering a cycle of economic contraction that can be challenging to reverse, ultimately increasing the risk of a recession.

Business Responses to Economic Uncertainty

Businesses are not immune to the pressures of economic uncertainty, which can lead to cautious strategies in investment and spending. As illustrated by Delta CEO Ed Bastian’s caution over revenue projections due to ‘broad economic uncertainty around global trade’, businesses might postpone expenditures and expansion plans. These strategic retreats are often necessary as companies must assess the long-term viability of their operations amidst fluctuating tariffs and trade policies. In environments where uncertainty prevails, companies often choose to prioritize financial stability over growth.

Additionally, smaller firms, like TJ Semanchin’s Wonderstate Coffee, showcase how tariffs and economic unpredictability can compress budgets and lead to a more defensive posture in the business climate. Such firms may delay capital investments, opting instead to conserve cash until a clearer economic landscape emerges. With a more cautious approach to operations, businesses are exercising prudence to navigate uncertain waters, often leading to stifled innovation and reduced competitiveness during economically turbulent times.

Consumer Confidence Decline Amidst Economic Turbulence

The connection between consumer confidence and economic conditions is a delicate balance that can shift rapidly, especially amid uncertainty. The data from the University of Michigan Survey of Consumers indicates that consumer confidence has seen a stark decline, dropping by more than 30% from previous months. This erosion of confidence is generally influenced by external factors such as employment levels, stock market volatility, and trade policies, all contributing to how consumers feel about their future financial situations.

As confidence wanes, the propensity for individual households to make large purchases diminishes significantly, with families choosing to save more rather than spend. This behavioral shift is particularly evident in sectors that rely on discretionary spending, such as travel and high-ticket items. In Renata Kero’s case, the decision to forego travel and postpone purchasing a new phone reflects a broader sentiment where consumers prioritize financial prudence over immediate gratification.

Tariffs Effects on the Economy and Business Operations

Tariffs can have profound implications for businesses and the economy as a whole, especially in an environment already fraught with uncertainty. The introduction or escalation of tariffs can lead to increased costs for imports, which businesses must then decide how to absorb or pass onto consumers. For instance, TJ Semanchin noticed an immediate impact on his coffee sourcing costs due to potential tariffs on products from countries like Nicaragua, demonstrating how sudden policy shifts can disrupt supply chains and inflate prices.

Furthermore, these tariffs contribute to an atmosphere of unpredictability, compelling businesses to reassess their operational strategies. As companies like FedEx and Delta have noted, uncertainty stemming from tariffs can lead to revenue projections that are less optimistic and more cautious than previously anticipated, impacting investment and hiring plans. The potential for ongoing tariffs underscores the need for businesses to maintain flexibility and resilience in their operations while navigating this complex economic landscape.

Recession Risk Due to Uncertainty in the Market

The link between economic uncertainty and the increased risk of recession is well-documented in economic theory. When uncertainty permeates the financial landscape, both consumers and businesses tend to adopt a conservative approach to spending and investment. Such behavior can result in decreased demand for goods and services, which may ultimately cause GDP contraction and heighten the risk of a recession. As precisely noted by economists, a downturn in consumer confidence can lead to precautionary savings, further stagnating economic activity.

In light of this, it is essential for policymakers to address sources of uncertainty that can precipitate economic downturns. The abrupt changes in trade policies, tariffs, and fiscal restrictions can send shockwaves through consumer and business confidence, leading to an environment ripe for recession. As consumers remain hesitant to invest in large purchases and businesses scale back on expansion plans, the cumulative effect may well usher in an era of economic decline, underscoring the critical nature of stable and predictable economic policies.

Navigating Economic Uncertainty: Business Strategies

In light of the pervasive economic uncertainty, businesses must devise strategies that allow them to navigate turbulent waters effectively. Adopting a more agile financial strategy can prepare organizations to respond quickly to market changes, thereby reducing risks associated with economic shocks. Companies may implement cost-cutting measures, prioritize essential investments, and enhance liquidity to remain viable during unpredictable economic climates. This strategic flexibility enables them to respond to shifting consumer demands while also positioning themselves to capitalize on opportunities when stability returns.

Moreover, diversifying supply chains and exploring alternative sourcing options can help mitigate the risks associated with global trade uncertainties. Firms that proactively manage their supply chains can reduce their dependency on high-risk markets and adjust more readily to sudden tariff changes or trade disruptions. Maintaining open lines of communication with stakeholders can further assist in adapting to changes and devising contingency plans that respond to evolving economic conditions.

The Role of Consumer Behavior During Uncertain Times

Consumer behavior is often a reflection of prevailing economic conditions, particularly during times of uncertainty. Households tend to exhibit cautious spending habits, which can significantly impact overall market activity. When uncertainties surrounding employment, healthcare, and prices loom large, consumers become less willing to incur debt or commit to large purchases, affecting businesses relying heavily on consumer spending for growth. Renata Kero’s decision to defer purchasing a new phone is emblematic of this protective consumer behavior.

Additionally, businesses must pay thoughtful attention to the shifts in consumer sentiment and adapt their marketing strategies accordingly. Understanding that consumers may prioritize essential purchases and seek value in brand offerings can help businesses tailor their products and messaging to align with current consumer needs. By fostering trust and transparency, companies can maintain customer loyalty even in times of economic instability, helping them weather the storm of uncertainty.

Impacts of Economic Policy Changes on Market Dynamics

Changes in economic policy can significantly shift market dynamics, influencing both consumer confidence and business strategies. Sudden changes, such as the introduction or suspension of tariffs, can create market disturbances that compel consumers and businesses to reassess their spending and investment plans. For example, the instability introduced by tariff negotiations in the current environment has led to a sense of skepticism among businesses regarding pricing strategies and operational budgeting, fostering an atmosphere where caution is prioritized over bold investments.

Policymakers must therefore recognize the pervasive influence of their decisions on economic behavior. When policies are unpredictable, the potential for backlash from consumers and businesses grows, as each sector grapples with anxiety about future market conditions. Clear, consistent communication regarding economic policies can help alleviate some of this trepidation, enabling market participants to make informed decisions rather than reacting purely out of fear or uncertainty.

Forecasting Economic Outcomes Amidst Turbulence

Forecasting economic outcomes during periods of uncertainty presents significant challenges. As the current climate demonstrates, economic predictions can be widely divergent, influenced by an array of factors, including consumer sentiment, global trade relations, and domestic policy shifts. Economists emphasize the importance of considering the broader implications of tariff changes on economic forecasts, as these can result in both immediate and long-term repercussions on market stability and growth trajectories.

In addressing this complexity, companies and investors often rely on indicators such as consumer confidence indexes and market volatility measures to gauge potential future developments. Implementing more robust predictive models that account for uncertainty can empower businesses to develop flexible strategies that adapt to rapid changes in market conditions. By remaining vigilant and responsive to emerging trends, market participants can better position themselves for success, even in unpredictable economic landscapes.

Frequently Asked Questions

What is the impact of economic uncertainty on consumer spending?

Economic uncertainty significantly impacts consumer spending by causing individuals to feel cautious about their financial decisions. With declining consumer confidence, people tend to postpone large purchases and reduce discretionary spending in anticipation of potential job loss or adverse changes in the economy. This cautious approach ultimately leads to a slowdown in economic growth as businesses also experience reduced sales.

How does economic uncertainty affect business response to uncertainty?

Businesses facing economic uncertainty often adopt a defensive posture, scaling back investments and avoiding major expenditures. This hesitation stems from the unpredictability of market conditions and government policies, which makes it difficult for companies to plan effectively for the future. As a result, many businesses may delay hiring or expansion plans until there is greater clarity about the economic environment.

What role do tariffs play in amplifying economic uncertainty?

Tariffs can exacerbate economic uncertainty by introducing unpredictability into trade costs and supply chain dynamics. Frequent changes in tariff policies can lead businesses to reassess their pricing strategies and cost structure, which heightens concerns about profit margins. This ongoing uncertainty drives businesses to be more cautious in their operational and investment decisions, ultimately influencing broader economic conditions.

How does consumer confidence decline due to economic uncertainty?

Consumer confidence declines during periods of economic uncertainty because individuals become more aware of instability in job markets, income potential, and inflation rates. As negative news circulates—such as tariffs, layoffs, and stock market volatility—consumers may feel insecure about their financial situations, prompting them to curtail spending and adopt a wait-and-see approach, further slowing economic momentum.

What are the recession risks associated with economic uncertainty?

Recession risks tend to rise during periods of high economic uncertainty as both consumers and businesses become more conservative in their spending habits. When economic conditions are unstable and confidence is low, decreased consumer demand can lead to reduced business revenues, slowing growth rates, and ultimately tipping the economy into a recession. Monitoring these trends is crucial for anticipating potential downturns.

| Key Points | Details |

|---|---|

| Consumer Behavior | Families are delaying significant purchases due to economic uncertainty, with consumer confidence dropping more than 30% since last November. |

| Business Concerns | Companies like Delta and FedEx are projecting potential revenue declines due to global trade uncertainties. |

| Impact on Small Businesses | Small-business optimism has decreased, with many owners scaling back on sales growth expectations amid policy changes. |

| Economic Predictions | Economists are concerned that ongoing uncertainty could trigger a recession due to reduced spending. |

| Precautionary Measures | Businesses and consumers are adopting defensive postures, postponing investments and major expenditures. |

Summary

Economic uncertainty is exerting a significant influence on consumer and business behavior. As seen in the current climate, families are choosing to postpone major purchases and investments due to an unpredictable economic landscape featuring fluctuating tariffs and changing government policies. This growing wariness among consumers and businesses is contributing to a cycle of reduced spending, which can further exacerbate economic downturns. The overarching narrative is clear: economic uncertainty breeds caution and retrenchment, creating a challenging environment for all.