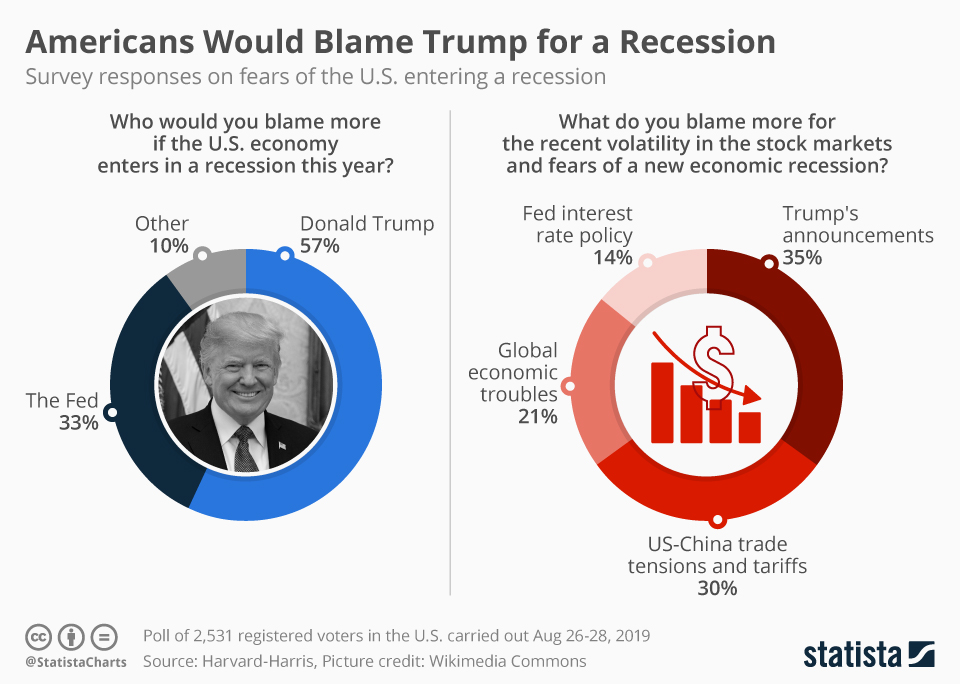

The narrative of the Trump economy blame has become a central theme in the discourse surrounding the United States’ economic challenges. Many critics point to the actions of Federal Reserve Chairman Jerome Powell and his reluctance to cut interest rates as complicit in the economic downturn. Trump’s aggressive use of tariffs, particularly in the escalating trade war with China, has also sparked debate among economists and investors alike. The recent US economic forecast released by the International Monetary Fund has drawn attention, with increasing fears of a recession, now estimated to have a 37% likelihood. As Trump navigates these treacherous waters, the pressure mounts—not only from his critics but also from investors seeking stability and reassurance in uncertain times.

In discussions about the economic performance of the nation, the focus often shifts toward the administration’s policies and strategies. Critics argue that President Trump’s blame game, particularly against Jerome Powell and his Federal Reserve policies, reflects a misunderstanding of the complexities involved in managing our economy. The tariffs and trade strategies employed during the ongoing trade confrontation with China have led to significant repercussions for American businesses and consumers alike. As economic projections dim, the question rises: who truly carries the responsibility for the current fiscal climate? It’s essential to analyze all angles—ranging from monetary policy impacts to international trade relations—to understand the broader implications of these decisions.

Understanding the Role of the Federal Reserve in Economic Growth

The Federal Reserve plays a crucial role in shaping the economic landscape of the United States. Under the leadership of Jerome Powell, the Fed is tasked with maintaining price stability and maximizing employment. When economic growth shows signs of stagnation, as it has in recent months, many look to the Federal Reserve to lower interest rates as a means to stimulate the economy. High interest rates can discourage investment and spending, leading to slower growth. Unfortunately, while the Fed remains committed to its goals, political pressure from figures like President Trump complicates its independence and decision-making.

As the economy teeters on the brink of recession, the decisions made by the Federal Reserve become even more critical. Recent shifts in economic forecasts, including the IMF’s downgrading of U.S. growth projections, underscore the delicate balance the Fed must maintain. With Trump publicly blaming Powell for the economic downturn, it raises questions about the long-term implications of politicizing such an essential institution. Investors and economists alike are left wondering whether the Fed can act decisively without the hindrance of political pressures while addressing the mounting concerns around inflation.

Trump’s Economic Blame Game: Shifting Responsibilities

In the face of economic challenges, President Trump has consistently turned to blame, often directing his ire toward the Federal Reserve and Jerome Powell for the state of the economy. This blame game not only distracts from the myriad complex factors influencing economic performance, including the ongoing trade war with China and the repercussions of Trump tariffs, but also undermines efforts to establish a stable economic environment. Critics argue that the President’s approach may lead to further instability, as the stock market responds negatively to uncertainty stirred by erratic statements.

Moreover, Trump’s insistence on scapegoating Powell comes at a time when significant economic indicators, such as an increased likelihood of recession, are becoming apparent. With Gallup polling indicating that 42% of Americans feel the economy is already in recession, it’s crucial to analyze the factors contributing to these sentiments. The ongoing trade tensions, particularly the imposition of tariffs both ways, have compounded the economic landscape, leading to investor anxiety. By shifting blame rather than addressing systemic issues, the administration risks alienating investors and hindering potential economic recovery.

The Impact of Trump Tariffs on the U.S. Economy

Trump’s tariffs have reshaped the dynamics of U.S. trade, particularly with China, leading to a significant increase in import costs. The recent statistics reveal that tariffs are adding 145% to U.S. imports as China retaliates with an additional 125% on its imports. This trade war not only affects consumer prices but also stifles economic growth by creating uncertainty for businesses. As companies face higher costs, the ripple effect can inhibit hiring and investment, further exacerbating the challenges within the domestic economy.

The economic consequences of these tariffs are evident in the revised forecasts from the IMF, which have downgraded U.S. economic growth expectations. As the tariffs bite and tensions escalate, the risk of recession looms larger. The Federal Reserve’s role becomes even more critical as policymakers evaluate how to respond to the economic fallout from trade policies and tariffs. Investors are left in a precarious position, navigating a market influenced heavily by political decisions and global trade relations.

Analyzing the Trade War with China: Consequences and Predictions

The ongoing trade war between the U.S. and China has significant implications for both economies and is likely to define the economic landscape for years to come. With tariffs escalating on both sides, businesses are caught in a cycle of uncertainty that discourages investment and increases operational costs. The desire for de-escalation highlighted by figures like Scott Bessent is essential but fraught with challenges, as both nations appear entrenched in their demands. The prospects for a negotiated resolution seem distant, further complicating the U.S. economic outlook.

As U.S. firms grapple with the consequences of these tariffs, the outlook for the economy remains uncertain. Experts warn that prolonged trade tensions could lead to a slowdown, affecting everything from employment rates to GDP growth. The Federal Reserve’s ability to implement effective monetary policy is further challenged by this turbulent trade environment, with economic forecasts reflecting heightened fears of a slowdown. Investors must remain vigilant as the outcome of the trade war continues to unfold, with potential ramifications for the global economy.

The Economic Consequences of Rising Inflation

Rising inflation presents a significant challenge for the U.S. economy, influencing everything from consumer spending to Federal Reserve policy decisions. Core inflation rates, which have reached their lowest since March 2021, suggest a mix of sluggish growth and potential price pressures. As the Fed considers interest rate adjustments, the implications of rising inflation create a difficult balancing act: stimulating growth while keeping prices in check is no easy feat. Jerome Powell’s decisions during this period will be closely scrutinized, particularly in the context of Trump’s mounting criticism.

The risks associated with increased inflation are multifaceted. If the Federal Reserve lowers rates significantly to counteract economic stagnation, it could inadvertently set the stage for runaway inflation, further complicating the economic recovery. This prospect is particularly concerning in light of the looming recession predicted by many economists. As the administration focuses on blaming external factors, like Powell’s policies, for economic woes, it is essential to address the underlying inflationary pressures that could hinder recovery efforts.

How Investor Sentiment Shapes the Economic Landscape

Investor sentiment is a critical driving force in the economy, influencing everything from stock market performance to corporate investment decisions. The uncertainty stemming from the White House’s messaging, especially regarding Jerome Powell and the Federal Reserve, can lead to significant volatility in markets. Recent observations indicate that when key administration figures like Scott Bessent address the economy, markets tend to react positively; however, this effect is often short-lived due to the underlying instability of the messaging.

As economists highlight the vital role of consistent and reliable communication in maintaining investor confidence, the current administration’s mixed signals could potentially lead to greater market turbulence. The necessity for coherent policy direction amidst ongoing trade tensions and economic uncertainty becomes paramount. Investors thrive on stability, and without it, the potential for economic recovery diminishes as they weigh the risks of their investments against the backdrop of shifting political narratives.

International Economic Dynamics: A Look at FDI Trends

Foreign Direct Investment (FDI) remains a cornerstone of the U.S. economy, with over $5 trillion held by non-American investors. The allure of the United States as an investment destination is tied to its perceived political stability and economic potential. Yet, in light of ongoing trade wars and fluctuating policies, the attractiveness of the U.S. market may wane. As investors look for secure opportunities, the narratives emerging from Washington will play a critical role in shaping their confidence in the U.S. economy.

The IMF’s insights into global investment patterns indicate that any significant downturn in U.S. economic performance could impact FDI flows. Investors are increasingly cautious as they assess the risks associated with trade wars and tariffs, particularly those stemming from conflicts with major trading partners like China. Understanding these dynamics is essential, as they can forecast the future trajectory of economic growth and investor confidence in the stability of the U.S. market.

Evaluating Trump’s Economic Policies and Their Impact on Growth

Trump’s economic policies have been met with mixed reviews, particularly as concerns grow over their long-term sustainability. The combination of aggressive tariff strategies and unpredictable communication has left many analysts questioning the effectiveness of these measures. While the administration touts policies aimed at invigorating the manufacturing sector, the reality of economic indicators suggests a more complex picture, characterized by slowing growth and potential recession. As such, many wonder if these tactics truly align with the interests of the American economy.

As the Trump administration grapples with rising public concern over economic conditions, it remains to be seen how these policies will evolve. The relationship between trade, tariffs, and federal monetary policy is intricate, often obscured by political rhetoric. For investors and constituents alike, understanding these policies’ nuanced implications is vital as they navigate an uncertain economic landscape. The potential for recession, elevated by escalating tariffs and changes in Federal Reserve strategy, casts a long shadow over the future of U.S. economic growth.

Looking Ahead: The Future of the U.S. Economy

With increasing odds of recession and declining growth expectations, the future of the U.S. economy hangs in the balance. As economic indicators fluctuate and global tensions escalate, the need for cohesive policy and stability becomes undeniably clear. Investors are increasingly wary as they seek clarity in an environment marked by uncertainty and rapid changes. The Federal Reserve’s actions, coupled with the administration’s economic responses, will significantly influence the trajectory of growth. Observing how these elements interact will be crucial for stakeholders.

The outlook for the U.S. economy is rife with challenges yet filled with potential for recovery, depending on the actions taken in the following months. The interplay of the Federal Reserve’s monetary policy under Powell, coupled with Trump’s often contradictory statements and the overarching influence of global trade dynamics, will determine the path forward. Interest rates, inflation, and international relations are all key factors that will shape the economic landscape in the months to come, necessitating vigilance and adaptability from investors and policymakers alike.

Frequently Asked Questions

Why does Trump blame the Federal Reserve for the economy?

Trump often blames the Federal Reserve, specifically Chairman Jerome Powell, for failing to lower interest rates, which he believes could stimulate economic growth. He asserts that Powell’s decisions have contributed to economic stagnation and volatility in the markets.

What impact do Trump tariffs have on the US economy?

Trump’s tariffs, particularly those imposed during the trade war with China, have led to increased costs for consumers and businesses. The administration claims these tariffs protect American jobs, but many economists argue they contribute to overall economic downturns and uncertainty.

How does the US economic forecast relate to Trump’s economic policies?

The US economic forecast has been downgraded during Trump’s presidency due to concerns over tariffs, trade wars, and the Federal Reserve’s policies. As the IMF recently reduced growth estimates, it’s evident that Trump’s approach to the economy is being scrutinized for its long-term effectiveness.

What is the relationship between Trump’s economic policies and recession fears?

Many Americans believe the economy is already in recession, with rising fears linked to Trump’s tariffs and trade policies impacting consumer sentiment and market stability, further exacerbated by his fluctuating relationship with the Federal Reserve.

How do Trump’s comments affect investor confidence in the economy?

Trump’s erratic statements regarding the economy and the Federal Reserve often create market volatility. Investors tend to respond cautiously to uncertainty, particularly regarding trade policies and interest rate decisions influenced by Trump’s administration.

Why do people think Trump is not taking responsibility for economic issues?

Trump frequently shifts blame to the Federal Reserve and other factors rather than addressing his tariffs and trade policies, which many analysts believe have detrimental effects on economic growth and investor confidence.

What role does Jerome Powell play in Trump’s view of the economy?

Jerome Powell, as the Federal Reserve Chair, is often portrayed by Trump as a scapegoat for economic problems. Trump criticizes Powell for not lowering interest rates to promote growth, indicating a belief that the Fed’s policies directly parallel his own economic outcomes.

How might the trade war with China affect the US economic outlook?

The trade war with China adds complexity to the US economic outlook, as ongoing tariffs and barriers threaten growth. Experts fear that prolonged negotiations without resolution could hinder economic recovery and investor confidence.

What has been the effect of Trump’s tariffs on inflation?

Trump’s tariffs have potential inflationary effects, as increased import costs can lead to higher prices for consumers. However, the core inflation rate has remained low recently, suggesting that the immediate impact may be limited but still a concern for future economic stability.

How do market reactions reflect the uncertainty created by Trump’s economic policies?

Market reactions demonstrate significant volatility and sensitivity to Trump’s economic policies, especially as he switches between asserting confidence and expressing dissatisfaction with the Federal Reserve, creating an environment of uncertainty that investors find challenging.

| Key Points |

|---|

| Trump blames Federal Reserve Chairman Jerome Powell for the economy’s struggles, particularly for not lowering interest rates. |

| Trump’s tariffs and trade negotiations are criticized as contributors to the failing economy. |

| Investors show concern over economic stability due to Trump’s unpredictable policies. |

| The IMF has revised its US economic growth forecast down to 1.8% for this year. |

| Investor confidence is shaken, with 42% of Americans believing the economy is in recession. |

| Powell’s reluctance to adjust rates is seen as politically motivated by the White House. |

Summary

The topic of Trump economy blame is a pressing issue as President Trump continues to shift responsibility for the economic downturn onto Federal Reserve Chairman Jerome Powell. By claiming that the lack of interest rate cuts is the primary cause of economic struggles, Trump deflects attention from his administration’s own tariff policies and trade wars that have contributed significantly to investor uncertainty and market volatility. As the IMF revises growth forecasts downward and more Americans express recession concerns, the narrative from the White House suggests a strategic attempt to scapegoat Powell rather than address the multifaceted challenges facing the economy.