As the 2025 tax extension deadline approaches, many taxpayers begin to contemplate their options for filing their returns. Understanding the ins and outs of the IRS tax extension can provide valuable relief during the hectic tax filing season 2025. If you are unsure about how to navigate this year’s tax deadlines, rest assured that you can apply for a tax extension application to gain additional time to file. However, it’s crucial to remember that while you can delay your filing, you must still pay any owed taxes by the 2025 tax deadline. Using trustworthy tax professionals is essential to avoid potential scams and ensure a smooth tax experience this year.

As we approach the tax season of 2025, many individuals might be considering an extension for submitting their tax returns. Filing your taxes can often be a daunting task, and that’s where a tax filing extension comes in handy. This extension provides taxpayers with extra time to organize their financial documents without the stress of meeting the imminent deadline. Moreover, understanding the rules associated with the IRS tax extension will empower you to manage your obligations effectively. If you’re eager to learn how to file taxes in 2025, exploring available options and resources can ease your journey through the upcoming tax period.

Understanding the Need for a 2025 Tax Extension

As the 2025 tax filing season approaches, many individuals may find themselves feeling overwhelmed and wondering if they need more time to prepare their tax returns. The IRS has confirmed in communications that a significant number of the American public are seeking assistance from tax professionals. This reliance on professional help is essential to navigate the complexities of tax codes and avoid the risk of becoming victims of fraud, particularly during the high-pressure tax filing season.

Obtaining a tax extension can alleviate some stress and pressure during this busy time. However, it is important for taxpayers to understand that a tax extension only provides additional time to file— it does not give an extension on the time to pay any taxes owed. Consequently, individuals should closely monitor their financial standings and make sure they have a plan for payment to avoid penalties.

Key Dates for the 2025 Tax Deadline

The official due date for filing taxes in 2025 is set for April 15. This date marks the end of the grace period for submitting taxes owed to the federal government. As such, taxpayers should be prepared ahead of schedule, ensuring they gather all necessary documentation and receipts that may contribute to an accurate return. By understanding this crucial date, individuals can better plan their filing strategy and avoid the last-minute rush.

Moreover, taxpayers should stay informed about any upcoming changes or developments from the IRS concerning the 2025 tax filing season that could impact their filing schedules. Staying updated can prove essential, especially for those navigating special circumstances such as disaster-related extensions or unique income situations.

Extensions for Tax Filing: What You Need to Know

It’s fundamental for taxpayers to grasp the concept of a tax extension, which allows them an additional six months to complete and submit their returns beyond the typical April 15 deadline. While applying for a tax extension can provide relief, it is essential to understand that this extension only defers the filing of paperwork, not the actual taxation due. Taxpayers must still estimate and pay any taxes owed by the original deadline to avoid potential interest and penalties.

Filing for a tax extension can generally be accomplished quite easily through various methods. Taxpayers can utilize IRS Free File for an electronic submission, signal their intent while making payments online, or submit Form 4868 through mail or e-filing platforms. Regardless of the method chosen, ensuring that the application is submitted correctly and promptly is vital to maintain good standing with the IRS.

Disaster-Related Tax Extensions for 2025

In 2025, multiple states have experienced natural disasters that have prompted the IRS to allow tax deadline extensions for affected individuals. These extensions can provide vital relief for taxpayers who may be struggling to recover from severe weather incidents. For example, California wildfire victims have received the deadline extension to October 15, 2025, while those affected by hurricanes in several states have been granted extensions to May 1, offering them additional time to meet their tax obligations.

Taxpayers in impacted states must stay informed about their unique circumstances and the deadlines that apply. Check the IRS official page that details extensions by state, ensuring that you fulfill your obligations accurately. This information will help ensure compliance and understanding of the specific implications of disaster-related changes.

How to Apply for a 2025 Tax Extension Easily

Applying for a tax extension in 2025 is a straightforward process. You can take advantage of tools like IRS Free File, which streamlines the submission of your tax extension request electronically. In addition, if you pay through an online method, you might find an option to indicate that your payment is submitting as part of a tax extension.

Another reliable way to file for a tax extension is using Form 4868 by mailing it to the IRS or enabling electronic submission through an authorized e-filing platform. Regardless of the method you choose, ensure that your request is completed by the April 15 deadline for extensions, making your experience hassle-free during the tax filing season.

Avoiding Common Tax Extension Pitfalls

Many taxpayers who apply for an extension mistakenly believe that they have extra time to pay their taxes. It’s crucial to remember that while you may receive additional time to file your tax return, the payment deadline remains fixed. Underestimating the amount owed may lead to balancing penalties and interest accruing on the unpaid balance, adding frustration during the process.

Additionally, some individuals fail to gather all the required documentation before filing for an extension, leading to complications later. Preparing a checklist of necessary paperwork well in advance can smooth the paperwork process and support accurate filing once the deadline arrives. The more organized you are before April 15, the less you will feel stressed about the process.

Consulting a Tax Pro: Why It’s Beneficial for Your 2025 Filing

Given the complexities of tax codes and myriad changes each year, consulting a trusted tax professional can offer significant advantages during the 2025 filing season. Beyond helping understand potential deductions and credits, these experts can assist with tax extension applications and ensure compliance with IRS regulations, protecting you from fines and penalties during the filing process.

Furthermore, with the rising incidence of tax-related scams, enlisting the help of a tax professional can provide peace of mind that you are navigating the system safely and correctly. A professional will guide you through various scenarios, helping maximize your returns while minimizing your tax liability, ensuring you approach your financial tax obligations with confidence.

FAQs About the 2025 Tax Extension Process

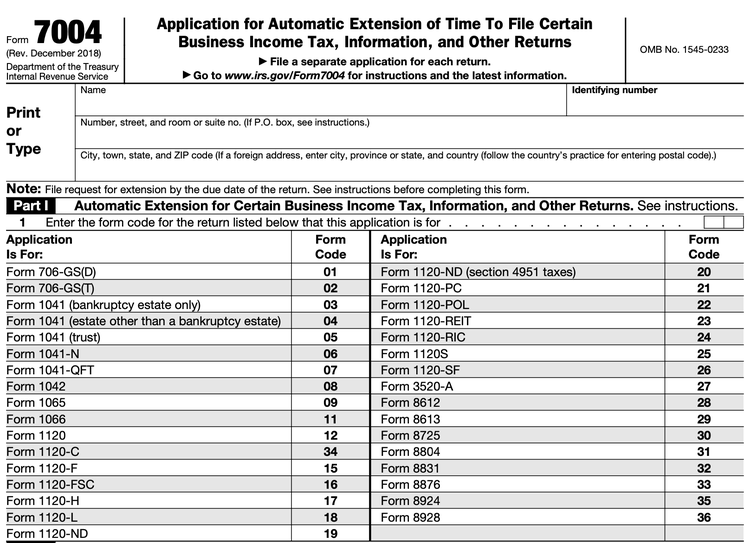

Many taxpayers might wonder about the common questions and pitfalls regarding the 2025 tax extension process. One of the most frequently asked questions revolves around whether taxpayers are allowed to apply for a tax extension for both personal and business tax returns, and the answer is yes. Individuals can use Form 4868 for personal tax extensions, while businesses should utilize Form 7004.

Another common inquiry involves the consequences of failing to pay estimated taxes on time. While an extension allows time for filing returns, the IRS will impose penalties and interest on late payments. Hence, it’s crucial for taxpayers to ensure that they estimate and pay any taxes owed based on their individual circumstances beforehand.

Wrapping Up: Preparing for Your 2025 Tax Filing Season

As the tax deadlines approach, being proactive in your tax preparation strategy is vital to ensure compliance with IRS guidelines. Whether you are seeking a tax extension or filing your returns on time, having an action plan, gathering necessary documents, and possibly working with a tax professional can significantly ease your journey. The implications of tax filings are substantial, and better preparation may facilitate smoother filing.

In summary, understanding critical dates, knowing the implications of extensions, and staying informed about changes to tax legislation can all contribute to a successful tax filing season in 2025. With the right information and strategy, you can confidently navigate the complexities of taxes and ensure you meet your obligations.

Frequently Asked Questions

What is the 2025 tax extension application process?

To apply for a 2025 tax extension, you can use IRS Free File to electronically request an automatic extension, select the extension option while making an online payment, or submit Form 4868, the ‘Application for Automatic Extension of Time To File U.S. Individual Income Tax Return.’ Ensure your application is submitted before the April 15, 2025 deadline.

What is the significance of the April 15, 2025 tax deadline?

April 15, 2025, marks the standard tax deadline for filing your returns. It’s important because any tax extension must also be filed by this date. The IRS has indicated that this date is crucial for avoiding penalties associated with late tax submissions.

Can I get a 2025 tax extension if I owe money?

Yes, you can apply for a 2025 tax extension even if you owe taxes. However, remember that an extension to file does not extend the time to pay your taxes due; you still need to estimate and pay any owed taxes by April 15, 2025, to avoid penalties.

How long is a 2025 tax extension valid?

A standard 2025 tax extension provides you with an additional six months to file your tax returns, giving you until October 15, 2025, to submit your completed taxes. However, it’s critical to pay any estimated taxes by the original deadline to avoid interest and penalties.

What happens if I miss the 2025 tax deadline without a tax extension?

If you miss the 2025 tax deadline of April 15 without filing for an extension, you may face penalties. The IRS typically imposes a failure-to-file penalty based on the amount owed, so filing for a tax extension can help mitigate these consequences.

Where can I learn more about state-level 2025 tax extensions?

For specific information regarding state-level extensions related to the 2025 tax deadline, you can visit the IRS’s state-specific pages or their Frequently Asked Questions for disaster victims. This resource provides detailed information based on your state and the circumstances affecting tax deadlines.

Is it necessary to hire a tax professional for the 2025 tax extension application?

While it’s not necessary to hire a tax professional to apply for a 2025 tax extension, having one can be beneficial. A qualified tax pro can help ensure that all extensions are filed correctly and that you understand your obligations, especially if you’re affected by specific circumstances like natural disasters.

Can I file my 2025 taxes early and still apply for an extension?

Yes, you can file your 2025 taxes early. However, if you think you may need more time to gather information or settle certain deductions, you can still apply for a tax extension by the April 15, 2025 deadline to push the final filing date to October 15, 2025.

| Key Point | Details |

|---|---|

| 2025 Tax Deadline | April 15, 2025 (falls on a Tuesday) |

| States With Extended Deadlines | Due to natural disasters, some states have extended tax deadlines to October 15, May 1, or November 3, 2025, depending on the situation. |

| Tax Extension Definition | A standard federal tax extension gives taxpayers an additional six months to file their taxes but does not extend the time to pay owed taxes. |

| Filing for a Tax Extension | You can file for a tax extension via IRS Free File, when paying your taxes online, or by submitting Form 4868. Deadline for filing an extension is also April 15. |

Summary

The 2025 tax extension application process is essential for taxpayers who need additional time to file their tax returns. Understanding the deadlines and methods for applying helps ensure compliance with IRS regulations while avoiding penalties. As we approach the 2025 tax deadline of April 15, it is crucial for individuals, especially those affected by natural disasters in certain states, to stay informed on their eligibility for extensions and the proper filing procedures.