The recent debate surrounding US tariffs and their potential link to an economic downturn has sparked intense discussion among economists and consumers alike. As President Donald Trump’s tariffs on various imports create ripples across the market, experts warn of a looming recession in 2024, cautioning that these policies could shatter consumer confidence and destabilize the job market. “The tariffs have exacerbated inflation rates and uncertainty,” says Claudia Sahm, underscoring the fear that consumers may begin to tighten their spending. With the consumer confidence index already dipping for several consecutive months, the long-term impact on the economy appears increasingly dire. As businesses grapple with rising costs and fluctuating import prices, the ramifications on employment and consumer behavior are set to influence the landscape of the American economy for years to come.

In recent times, discussions about trade restrictions and their impact on economic stability have become increasingly critical. The implementation of protective tariffs under the Trump administration has left many wondering if the nation is on the brink of a financial crisis. Economic analysts are watching closely as these tariffs may disrupt the flow of goods and services, leading to heightened inflation and a tepid job market. This evolving situation not only affects large corporations but also influences everyday consumers, whose spending habits may change in response to fluctuating prices. As concerns rise about a potential economic slump in the coming months, the underlying effects of these tariffs will continue to shape fiscal narratives across the country.

The Domino Effect of Tariffs on the U.S. Economy

The recent imposition of tariffs by the Trump administration has created ripples throughout the U.S. economy, with many analysts predicting a potential recession on the horizon. As these tariffs impact both domestic and international trade, the ramifications extend far beyond immediate financial losses. Claudia Sahm, chief economist at New Century Advisors, notes that maintaining tariffs at current levels could make it challenging for the U.S. to sustain economic growth. Experts express concern that an environment marked by increased costs of goods could stifle consumer spending, which has been a pillar of economic strength.

Moreover, the uncertainty surrounding tariffs has adverse effects on consumer confidence and investment decisions. With the consumer confidence index dropping by 7.2 points in recent months, people are becoming increasingly cautious about their spending habits. John Veitch, dean of the School of Business, points out that wary consumers might postpone significant purchases like homes and vacations, further dampening economic activity. This cautious sentiment could lead to a feedback loop that exacerbates the economic slowdown, effectively stalling growth and pushing the U.S. closer to a recession.

Frequently Asked Questions

How do Trump tariffs impact the economic recession forecast for 2024?

The Trump tariffs contribute to economic recession forecasts for 2024 by increasing uncertainty in markets, which affects consumer confidence and spending. Economists warn that high tariffs can lead to reduced exports and increased prices, which may exacerbate inflation rates and slow down economic growth.

What effects do US tariffs have on consumer confidence during a recession?

US tariffs can negatively affect consumer confidence during a recession as higher costs for imported goods might discourage consumer spending. A decline in consumer confidence can create a vicious cycle, further slowing the economy and increasing recession risks.

What are the job market effects associated with US tariffs and a potential recession?

US tariffs may lead to job market fluctuations during a recession by causing businesses to limit hiring and investments due to increased costs and economic uncertainty. While some manufacturing jobs may be created, they are often highly automated and may not compensate for the job losses experienced in other sectors.

How do inflation rates relate to US tariffs and the risk of recession?

Inflation rates can rise due to US tariffs, which increase the cost of imports and products for consumers. As prices go up, consumer spending may decrease, potentially leading the economy closer to a recession if inflation outpaces wage growth.

Is the US economy prepared for a recession due to tariffs and rising inflation?

While the US economy has shown resilience post-pandemic, the potential for recession due to tariffs and rising inflation creates uncertainty. Economic experts suggest that the combined effects of tariffs and consumer behavior could impact economic stability.

| Key Point | Details |

|---|---|

| US Tariffs Impact | Political and economic turmoil is rising due to President Trump’s tariffs, leading to fears of a recession. |

| Expert Opinions | Claudia Sahm states it will be tough to avoid a recession if tariffs stay as they are. |

| Economic Growth | Tariffs combined with government downsizing will negatively affect economic growth. |

| Consumer Confidence | The consumer confidence index dropped by 7.2 points, indicating growing economic uncertainty. |

| Recession Definition | A recession is defined by the NBER as a significant decline in economic activity lasting more than a few months. |

| Historical Context | The U.S. has faced multiple recessions since the 2000s, including the Great Recession and the COVID-19 pandemic recession. |

| Job Market Effects | Businesses are likely to hold back on hiring and investments amidst uncertainty. |

| Automation in Employment | Many new jobs will be in automated roles rather than traditional manufacturing jobs. |

Summary

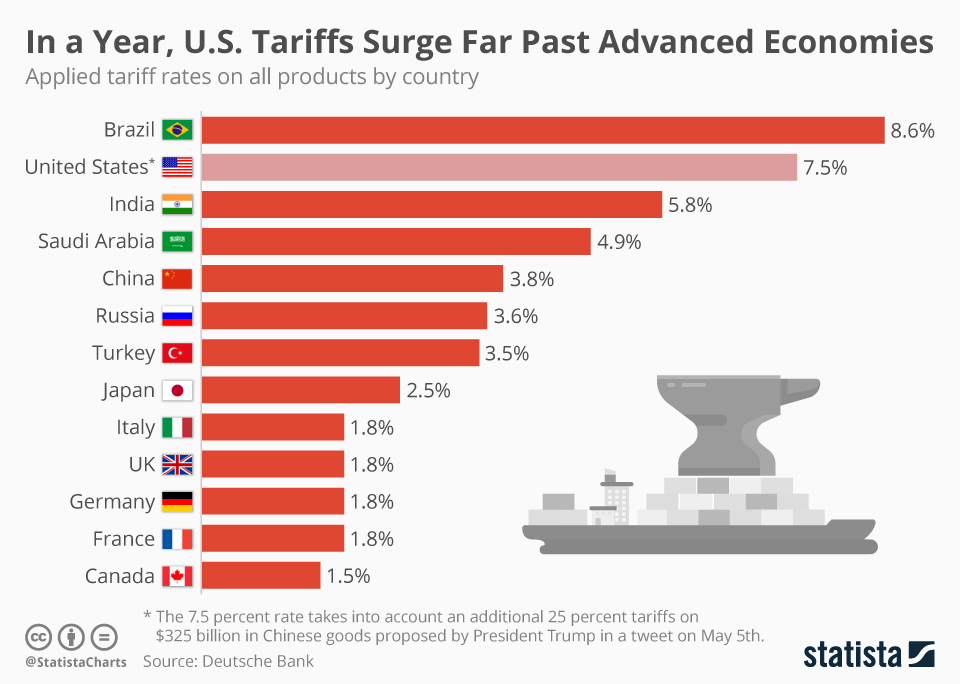

The discussion around US tariffs and recession highlights significant economic concerns. With numerous countries affected by President Trump’s trade policies, a potential recession looms as expert opinions suggest that the continued impact of tariffs may hamper economic growth and consumer confidence. As companies adjust to higher costs and uncertainties, the risk of decreased investments and hiring becomes more pronounced, challenging the economic landscape and everyday life for Americans.