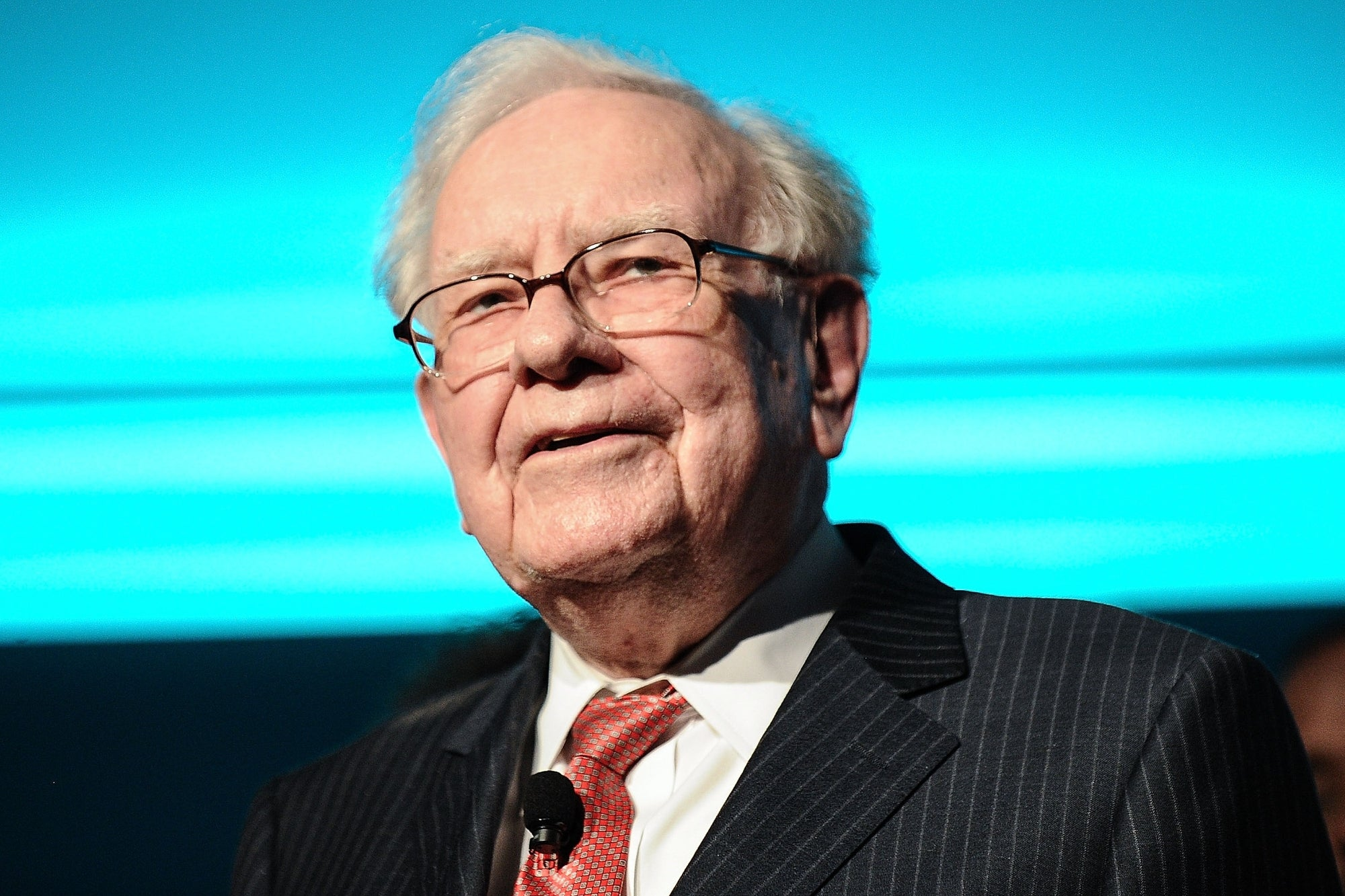

Warren Buffett’s retirement announcement has sent shockwaves throughout the investment community, marking a significant turning point for Berkshire Hathaway. During a recent shareholders meeting, the iconic investor revealed his plans to step down by the end of the year and has been vocal about his recommendation for Greg Abel to ascend as CEO. This pivotal moment in Berkshire Hathaway’s history raises questions about the future of the company and potential reactions from investors as they ponder the transition of leadership. As the long-time face of Berkshire, Buffett’s departure is certain to spark discussions about his successor and how Abel will carry forward Buffett’s legacy. The Berkshire Hathaway news is already buzzing with speculations, and investors are keen to witness how this transition will shape the company’s future under new leadership.

The recent declaration regarding Warren Buffett’s withdrawal from active leadership opens a new chapter for Berkshire Hathaway. Known as the Oracle of Omaha, Buffett has led the conglomerate with exceptional skill for over six decades, and his planned retirement at year’s end has caught many off guard. As discussions emerge about Greg Abel’s appointment as CEO, market analysts and shareholders alike are keenly observing how this shift will influence Berkshire’s operational dynamics. With investor reactions ranging from cautious optimism to speculative concerns about the effectiveness of Buffett’s chosen successor, industry experts are weighing in on the potential impact of this pivotal leadership change. The eventual evolution of Berkshire Hathaway’s leadership heralds exciting opportunities as well as challenges moving forward.

Warren Buffett Retirement Announcement: A New Era Begins

Warren Buffett’s unexpected announcement regarding his retirement has sent shockwaves through the investment community, marking the end of an iconic era for Berkshire Hathaway. After decades of leadership, Buffett has chosen to recommend Greg Abel as his successor, signaling a pivotal shift in the company’s direction. As Buffett stated, ‘I think the time has come for Greg to take over as Chief Executive Officer of the company by the end of the year.’ This decision underscores not only Buffett’s preparedness for retirement but also his steadfast confidence in Abel as both a leader and visionary.

Buffett’s retirement at the age of 94 comes after a long and illustrious career that has brought tremendous value to shareholders. During his tenure, he transformed Berkshire Hathaway into one of the largest and most respected conglomerates globally. As investors react to this monumental news, many express optimism about Abel’s capabilities, with the potential for a smoother transition in company leadership. It remains critical for Berkshire Hathaway’s future to adapt effectively to this leadership change, preserving the company’s distinctive culture while navigating new challenges under Abel’s management.

The Strategic Shift in Berkshire Hathaway Leadership

With Greg Abel set to take the helm as CEO, Berkshire Hathaway’s leadership is expected to undergo significant changes. Having overseen the non-insurance operations of the conglomerate, Abel’s promotion allows for continuity in the company’s operations while also paving the way for strategic innovation. Warren Buffett has long highlighted Abel’s exceptional business skills, suggesting that he will inject a fresh perspective into the leadership style of the company. Investors are watching closely to see whether Abel can maintain the balance between preserving Buffett’s legacy and making necessary adjustments for future growth.

Investor reactions to this leadership shift have been largely positive, with many analysts expressing confidence in Abel’s ability to navigate the complexities of Berkshire’s diverse portfolio. For instance, Omar Malik of Hosking Partners emphasized that Abel has had ample time to learn from Buffett, making him a suitable candidate to manage investments effectively. However, the challenge lies in whether Abel can emulate Buffett’s unparalleled investment acumen while developing his own leadership identity. This evolution in management is something that both shareholders and industry observers are keenly watching.

Berkshire Hathaway News: Navigating a Changing Landscape

As news of Warren Buffett’s retirement circulates, Berkshire Hathaway must now navigate a rapidly evolving financial landscape. Abel will inherit a corporate structure that is unique in its ability to adapt to market changes. Despite being known for its long-term investment strategy, the company faces pressures from an increasingly volatile market, especially in light of recent geopolitical tensions. Analysts suggest that the success of Abel’s leadership will depend heavily on his capacity to respond to these external pressures without compromising Berkshire’s core values.

Additionally, the recent commentary from Buffett about limited attractive investment opportunities resonates with shareholders concerned about the company’s cash reserves, currently sitting at approximately $347.7 billion. This situation presents both a challenge and an opportunity for Abel as he steps into his new role. Investors will be looking for updates regarding how the new CEO intends to deploy this capital effectively to drive growth while maintaining Berkshire’s long-standing commitment to conservatism in investment selections.

Greg Abel: The Chosen Successor to Warren Buffett

Greg Abel’s ascension to the role of CEO is a testament to his demonstrated capabilities and familiarity with Berkshire Hathaway’s intricate operations. For years, he has been viewed as Buffett’s heir apparent, a sentiment solidified by Buffett’s faith in his judgment and business acumen. Abel’s leadership style is anticipated to be more active and perhaps more hands-on compared to Buffett’s famously laissez-faire approach. This shift could lead to new opportunities within the company as Abel aims to drive value and innovation.

However, being Buffett’s successor brings its own set of challenges. Abel must not only uphold the culture of Berkshire Hathaway but also forge his path in an industry that is ever-changing. Investors have expressed their hope that he will successfully manage Berkshire’s vast investments, even as they question whether he can replicate Buffett’s legendary capital allocation performance. Ultimately, Abel’s strategy will be crucial in retaining investor trust and demonstrating that he can lead Berkshire Hathaway into a new chapter.

Investor Reactions to Buffett’s Retirement

The announcement of Buffett’s retirement has elicited varied reactions from investors, showcasing a mix of optimism and caution. While many shareholders express support for Abel’s appointment, there are underlying concerns regarding the continuity of Buffett’s unique investment philosophy. Analysts like Cathy Seifert believe this decision, while momentous, allows Buffett to leave on his terms—an essential aspect of his legacy. How investors respond moving forward as Abel takes the reins will be instrumental in shaping Berkshire Hathaway’s trajectory.

Ongoing investor sentiment will likely hinge on Abel’s ability to maintain the trust and strategies established by Buffett. For professionals like Cole Smead, there’s an apprehension about whether Abel will receive the same level of leeway afforded to Buffett and former Vice Chairman Charlie Munger. The future of Berkshire under Abel’s leadership may depend on transparency and clear communication strategies that reassure shareholders as they adjust to this monumental change.

Maintaining Berkshire Hathaway’s Legacy

Preserving the legacy of a company as monumental as Berkshire Hathaway is no small task, especially in light of transformative leadership changes. Many stakeholders are closely observing how Greg Abel will uphold the values and principles that have defined the company under Buffett’s stewardship. Abel’s experience and understanding of Berkshire’s intricate operations set a solid foundation for continuity, yet he faces significant pressure to establish his own identity as a leader.

As Abel prepares to step into his new role, both shareholders and industry experts anticipate a delicate balance of innovation and tradition. With Buffett’s commitment to retaining his investments in the company as a vote of confidence, there’s a shared expectation that Abel will facilitate a seamless transition while exploring avenues for growth. This may involve new operational strategies, investment approaches, and a renewed focus on sustainability within the company’s broad portfolio.

Future Prospects Under Greg Abel’s Leadership

Looking forward, the prospects under Greg Abel’s leadership at Berkshire Hathaway remain an area of keen interest among investors. With a wealth of experience overseeing significant segments of the company, Abel stands at the threshold of a promising future that hinges on how effectively he can adapt historically deterministic strategies to current market dynamics. Investors are watching to see how he manages the conglomerate’s diverse interests while implementing innovative strategies that align with the current economic climate.

The potential for Berkshire Hathaway to thrive under Abel’s leadership is compelling, particularly as he inherits a robust financial position. His approach to capital allocation and operational management could redefine how the company engages with emerging markets and investment opportunities. With a strong foundation laid by Buffett, the focus now shifts to how Abel can leverage this legacy to drive sustained growth and navigate through potential economic headwinds.

Berkshire Hathaway’s Financial Future: Challenges Ahead

As Berkshire Hathaway transitions into a new era with Greg Abel at the helm, navigating financial challenges remains a priority for the company. With Buffett expressing concerns about the current lack of appealing investment opportunities and significant cash reserves, Abel’s strategies for capital deployment will be scrutinized closely. Investors have historically appreciated Berkshire’s disciplined investment approach, and maintaining this amidst changing market conditions will be vital.

Moreover, the unpredictable nature of global markets adds another layer of complexity. Buffett’s reflections on trade policies and market fluctuations underscore the need for a resilient strategy that can withstand external shocks. Abel’s ability to react promptly to these changes and make informed decisions will play a critical role in ensuring Berkshire Hathaway continues to flourish while staying true to its investment philosophies.

Conclusion: A Legacy of Leadership at Berkshire Hathaway

Warren Buffett’s announcement of his retirement marks a defining moment for Berkshire Hathaway, bringing both excitement and trepidation among investors. As the company prepares to enter a new chapter under Greg Abel’s leadership, the emphasis will be on whether Abel can maintain the spirit of Buffett’s teachings while adapting to the contemporary investment landscape. With a legacy of prudent decision-making and strong performance, the foundation has been laid for a promising transition.

The roadmap ahead is fraught with challenges, but it also presents ample opportunities for innovation and growth. As the dust settles on Buffett’s departure, stakeholders will remain focused on how Abel navigates this pivotal period, ensuring that Berkshire Hathaway not only preserves its essence but also thrives under new leadership. The enduring legacy of Buffett and the strategic foresight of Abel will ultimately define the future success of this iconic investment firm.

Frequently Asked Questions

What does Warren Buffett’s retirement mean for Berkshire Hathaway’s leadership?

Warren Buffett’s retirement marks a significant transition in Berkshire Hathaway’s leadership, with Greg Abel set to take over as CEO. Buffett has called this the right time for Abel, who has managed many of the company’s non-insurance businesses and is perceived to be a capable leader for the firm moving forward.

Who is Greg Abel and how does he relate to Warren Buffett’s retirement?

Greg Abel is Warren Buffett’s chosen successor and will become the CEO of Berkshire Hathaway at the end of the year, following Buffett’s surprising announcement of his retirement. Abel’s extensive experience with the company’s operations positions him well to lead Berkshire into its next chapter.

What steps is Warren Buffett taking to ensure a smooth transition after his retirement?

Warren Buffett has committed to retaining his shares in Berkshire Hathaway and ensuring that the company remains strong under Greg Abel’s leadership. He believes that Berkshire’s prospects will improve under Abel’s management, which is a reassuring message for investors amid his retirement.

What are investor reactions to Warren Buffett’s announcement of retirement?

Investor reactions to Warren Buffett’s retirement announcement have been largely positive, as many believe Greg Abel is well-prepared to lead Berkshire Hathaway effectively. Buffeted by years of experience, Abel is expected to maintain a ‘business as usual’ atmosphere despite the leadership change.

How will Berkshire Hathaway’s investment strategy change with Greg Abel in charge after Buffett’s retirement?

While it’s uncertain how much Berkshire Hathaway’s investment strategy will change under Greg Abel, some investors expect a more hands-on management approach. However, Abel will need to balance dynamism in capital allocation without the same level of stock ownership as Buffett.

What legacy does Warren Buffett leave behind as he retires from Berkshire Hathaway?

Warren Buffett leaves behind a legacy of success and a strong culture at Berkshire Hathaway. After 60 years of leadership, he has established a solid foundation that Greg Abel will build upon, ensuring the company’s continued growth and resilience.

What challenges might Greg Abel face as Warren Buffett retires?

As Greg Abel steps into the CEO role following Warren Buffett’s retirement, he may face challenges related to capital allocation and gaining the same level of trust from investors. His success will largely depend on how well he adapts Buffett’s investment philosophies to his own style.

How has Warren Buffett’s health influenced his retirement decision?

Warren Buffett’s retirement has been influenced by his age and recent concerns about his health, as observers noted he appeared less sharp during recent public events. This decision reflects a strategic move to ensure smooth leadership transition rather than being driven by immediate health crises.

What are the implications of Warren Buffett giving control to Greg Abel?

By giving control to Greg Abel, Warren Buffett signals his confidence in Abel’s leadership and management abilities. This decision reassures investors that Berkshire Hathaway’s operational and investment strategies will continue, possibly even thriving under a new CEO.

What should shareholders expect from Berkshire Hathaway following Buffett’s retirement?

Shareholders can expect a period of adjustment as Greg Abel takes over as CEO following Warren Buffett’s retirement. While change is inevitable, the core principles of value investing and strong business practices instilled by Buffett are anticipated to remain at the heart of Berkshire’s operations.

| Key Points | Details | |

|---|---|---|

| Warren Buffett’s Retirement Announcement | Buffett announced at the annual meeting his intention to retire by the end of the year. | |

| Successor Designation | Greg Abel is recommended as his successor, becoming CEO of Berkshire Hathaway. | |

| Buffett’s Continued Investment | Buffett plans to keep his shares in Berkshire, believing in Abel’s leadership. | |

| Shareholder Reaction | The announcement received a standing ovation from thousands of investors. | |

| Concerns About Future Management | Questions remain about Abel’s ability to manage investments as effectively as Buffett. | |

| Trade Policy Views | Buffett criticized current trade policies, warning of their impact on global stability. | |

| Market Perspective | Currently, Berkshire holds $347.7 billion in cash, seeking future investment opportunities. | |

| Meeting Attendance | The annual meeting attracts around 40,000 attendees, including notable figures. | |

Summary

Warren Buffett’s retirement marks a significant transition for Berkshire Hathaway and its investors. After 60 years of remarkable leadership, his decision to step down and endorse Greg Abel as CEO reflects a pivotal change in the company’s future. While Buffett’s legacy of value investing is firmly established, there is cautious anticipation regarding Abel’s ability to navigate Berkshire through an evolving market landscape. As Buffett remains committed to his investments in the company, the coming year will be pivotal for both the management and the shareholders, underscoring the impactful legacy of a leader who reshaped the investment world.