The Trump Administration tariffs, instituted on April 2, marked a significant turning point in U.S. trade policy, introducing a 10% tax on all imported goods alongside various import tariffs targeting numerous countries. This sweeping move sent shockwaves through global markets, stoking fears of increased costs for American consumers and industries alike. Particularly in the realm of clean energy, the impact of these tariffs cannot be overstated; they are expected to drive up expenses for U.S. companies reliant on imported materials pivotal for manufacturing electric vehicles and solar technologies. Experts like Bentley Allan of Johns Hopkins University highlight the critical need for international components, stating that, without them, achieving climate goals would be considerably harder. As the struggle for energy independence intensifies, understanding the implications of the Trump Administration tariffs is essential for navigating the future of sustainable power generation.

The recent wave of import levies established during the Trump Administration fundamentally reshaped the landscape of international trade in the U.S. These import taxes not only affect foreign goods but also ripple through various domestic industries, particularly those focused on renewable energy. The increasing costs associated with electric vehicle production and solar energy systems can be traced back to these tariffs, influencing both manufacturers and consumers alike. Alternative strategies for energy sourcing are now complexly intertwined with the tariffs on overseas supplies, creating challenges for companies aiming to bolster their clean energy initiatives. Analyzing the broader ramifications of these tariffs will be vital for stakeholders seeking to adapt to evolving market conditions and policy frameworks.

The Impact of Trump Administration Tariffs on Import Costs

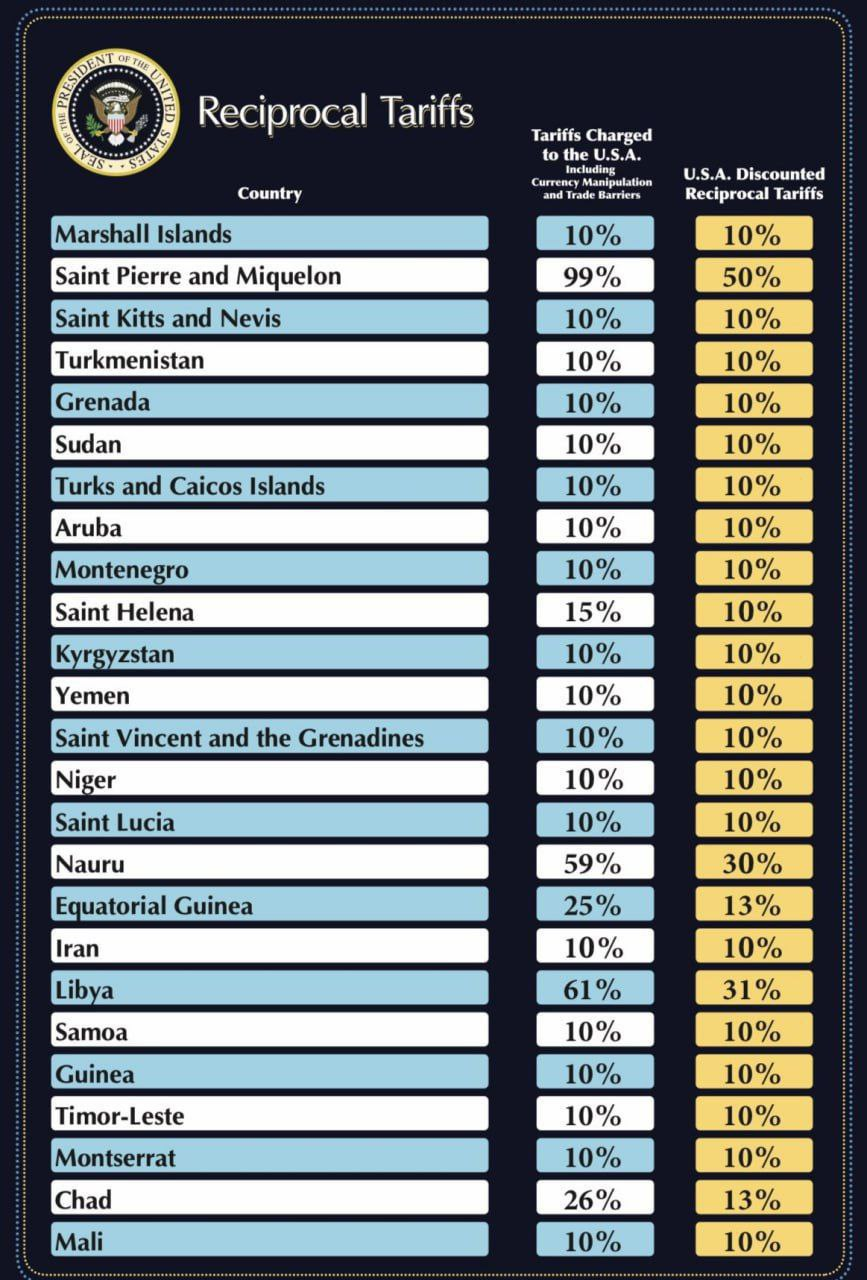

The Trump administration’s decision to impose extensive tariffs on imported goods has sent ripples through the economy, affecting various sectors, particularly the clean energy industry. The introduction of a 10% tariff on imported goods, along with additional higher tariffs for several countries, has raised alarm among businesses reliant on international supplies. These tariffs are anticipated to inflate the cost of essential materials and components used in domestic manufacturing, which could hinder growth in critical sectors like solar power and electric vehicle production.

Industry analysts argue that these tariffs could lead to increased product prices for consumers and businesses alike. While the aim of tariffs is to incentivize domestic production, the reality is that many U.S. companies depend on imports for essential materials needed to meet their production quotas and clean energy goals. For instance, clean energy firms, particularly in the solar and battery sectors, have flagged concerns that these tariffs may complicate the efforts to create a sustainable domestic supply chain and drive up their operational costs.

Challenges to Electric Vehicle Manufacturing Due to Tariffs

The electric vehicle (EV) industry has been on an upward trajectory, with manufacturers eager to ramp up production in response to government mandates. However, the imposition of tariffs by the Trump administration poses a significant hurdle for American manufacturers. A 100% tariff on Chinese-made EVs effectively closes off a crucial market just as the demand for electric vehicles is surging. As the automotive industry shifts gears towards sustainability, these tariffs are creating a bottleneck in the supply chain, leaving many manufacturers scrambling for alternatives to the necessary imported components.

Despite advancements in domestic manufacturing capabilities, manufacturers still rely heavily on parts imported from abroad. Tariffs on key materials such as lithium-ion batteries and essential minerals impede their ability to achieve production targets efficiently. The increased costs linked to tariffs slow down the adoption of electric vehicles, threatening the Biden administration’s goals of achieving a 50% quota of electric vehicle sales by 2030. Thus, while trying to promote domestic manufacturing, the tariffs may inadvertently stifle innovation and momentum within the EV sector.

The Effect of Tariffs on Solar Power Development

The solar power sector faces a myriad of challenges due to the high tariffs imposed on imported solar equipment. Since much of the solar technology utilized in the U.S. is sourced from Southeast Asia, the recent tariffs have endangered the operational viability of numerous solar development projects. Companies have begun stockpiling solar panels to withstand the immediate impacts of these tariffs, but the underlying concern is whether domestic production can ramp up in time to meet a growing demand for clean energy solutions.

Experts warn that the existing supply chain in the U.S. is not sufficiently robust to cover the influx of demand for solar energy. The pace at which expertise and capacity can be developed in the U.S. to manufacture solar equipment remains a significant barrier. The shock introduced by the tariffs could delay progress toward building a wholly domestic supply chain for solar energy components, ultimately hindering successful transitions to renewable energy sources and complicating efforts to meet climate goals.

Rising Costs of Batteries Amid Tariffs

Battery technology is at the forefront of the clean energy revolution, yet the rising costs associated with tariffs are constraining growth and innovation in this sector. With tariffs on grid batteries reaching approximately 65%, and potentially exceeding 80% in the future, the financial burden on U.S. manufacturers is expected to become increasingly heavy. This is concerning as the U.S. Energy Information Administration provided a positive outlook on battery storage, predicting a substantial increase in installations within the next few years.

Given that a majority of lithium-ion batteries used in these installations are imported from countries such as China, the ongoing tariffs disrupt the supply chain, driving up costs for domestic production. As battery prices globally decline due to oversupply, tariffs complicate the situation by negating these advantages and putting U.S. companies at a disadvantage. The higher upfront costs of batteries may hamper consumers’ willingness to adopt energy storage solutions, slowing the transition to a cleaner energy grid.

Long-term Consequences of Tariffs on Clean Energy

The long-term implications of Trump administration tariffs on clean energy industries could extend beyond immediate price increases. As U.S. companies face escalating costs for imported materials and components, the momentum toward renewable energy adoption may stall. The evolving landscape for clean technologies could see stagnation, as companies weigh the benefits of investing in domestic solutions against the inflated costs driven by tariffs. This environment may impede innovation and deter new entrants into the clean energy market.

Furthermore, while these tariffs intend to promote local manufacturing, they may inadvertently fortify reliance on fossil fuels. As experts note, the tariffs threaten to elevate drilling costs and prices for fossil fuel companies due to increased overheads on essential materials such as steel and aluminum. Consequently, the interconnectedness of tariffs and market dynamics could impose a long-lasting drag on the transition to green energy, complicating efforts to combat climate change effectively.

Economic Ripple Effects of Import Tariffs

The economic fallout from the Trump administration’s tariffs goes beyond the immediate sectors they target, affecting the broader economy in substantial ways. Tariffs not only increase the cost of goods but can also lead to inflation, as producers pass on their added costs to consumers. This inflation can suppress purchasing power and diminish economic growth, putting additional strain on households and businesses that rely on imported goods for their operations.

Countries affected by these tariffs, especially those that supply key materials for clean energy technology, are also likely to respond with their own trade barriers, which could escalate into a cycle of retaliatory tariffs. Such developments are harmful to global supply chains, particularly in an age where collaboration and international trade are critical for technological advancement and innovation. As relationships sour between trading partners, the cumulative effect will likely hinder progress in various industries, from electric vehicles to solar energy.

Addressing Battery Cost Challenges in Clean Energy Transition

In the quest to transition to a clean energy future, addressing the cost challenges associated with battery production has become crucial. As tariffs on imported lithium-ion batteries soar, U.S. manufacturers are faced with rising costs that can hinder their ability to deliver affordable energy solutions. An important consideration in overcoming these challenges is investing in domestic battery manufacturing capabilities to reduce dependency on overseas suppliers and mitigate tariff impacts.

Building a robust domestic battery supply chain involves not just the production of batteries but also the extraction and processing of critical minerals necessary for battery construction. By focusing on resource availability and supply chain efficiency, the U.S. can work towards lowering costs while boosting local economies. As companies innovate and invest in these technologies, they could provide new job opportunities and help position the U.S. as a leader in the rapidly evolving clean energy sector.

The Challenges of Crafting an American Solar Supply Chain

Creating a fully domestic supply chain for solar energy is a significant but challenging goal for the clean energy sector. The recent tariffs on solar panel imports have highlighted the due urgency for establishing a functional American solar supply chain, a task that requires substantial time and investment. Industry experts assert that the necessary technological knowledge and expertise to manufacture solar components domestically may take years to develop. Furthermore, current domestic production capacities are insufficient to meet the country’s expansive solar energy goals.

Without adequate infrastructure and investment in local manufacturing, the U.S. risks becoming overly reliant on foreign suppliers. The imposition of tariffs risks making solar projects financially unviable, deterring developers from pursuing such initiatives. As we explore opportunities for growth in the solar industry, creating a sustainable supply chain will be key to securing the future of solar power in America, allowing for energy independence and more competitive prices for consumers.

Microeconomic Impacts of Tariffs on Renewable Energy Adoption

The microeconomic impacts of the Trump administration tariffs are broad, affecting individual businesses and consumers engaged in the renewable energy sector. These tariffs not only raise the costs of importing essential components like solar panels and batteries but also significantly influence decision-making for companies seeking to invest in clean technologies. As costs rise, businesses may be forced to reevaluate their projects, postpone investments, or ultimately pass on costs to consumers, all of which can impede progress in renewable energy adoption.

As consumers grapple with higher prices for renewable energy technologies, their adoption rates may slow down. This stalling could present setbacks in meeting local and nationwide clean energy targets set by government policies. These microeconomic dynamics highlight the interconnectedness of tariff policies and the overall health of the renewable energy sector, where small business decisions can lead to larger economic implications that influence the drive towards a sustainable energy future.

Frequently Asked Questions

How do Trump Administration tariffs affect import tariffs on clean energy materials?

The Trump Administration tariffs implemented a range of import tariffs, significantly impacting clean energy materials such as lithium-ion batteries, solar panels, and other components. These tariffs have increased costs for U.S. companies reliant on imported materials, potentially impeding the growth and adoption of clean energy technologies.

What is the clean energy impact of Trump Administration tariffs on battery costs?

The tariffs introduced during the Trump Administration imposed a staggering 65% tariff on grid batteries, which could escalate to over 80%. This may mitigate the anticipated growth in battery storage adoption and elevate costs for manufacturers, as the majority of lithium-ion batteries are imported from China.

What effect did the Trump Administration tariffs have on electric vehicles?

The Trump Administration tariffs include a 100% tariff on Chinese-made electric vehicles, effectively banning their sales in the U.S. This poses a challenge for American manufacturers aiming to meet growing electric vehicle demands, as they depend on imported parts and materials, which are now subject to higher tariffs.

Are solar power tariffs under the Trump Administration affecting U.S. solar developers?

Yes, the solar power tariffs enacted by the Trump Administration have significantly impacted U.S. solar developers. The high import tariffs on solar equipment from Southeast Asia have led to increased costs and may lead to a shortage in domestic supply, complicating efforts to meet growing demand for solar energy.

How are Trump Administration tariffs impacting the price of fossil fuels?

Trump Administration tariffs on essential materials and components can raise the overall costs of fossil fuels, as the price of domestic energy inputs, including steel and aluminum, is affected. This inflationary pressure complicates the transition to clean energy while simultaneously increasing fossil fuel prices.

What are the long-term implications of Trump Administration tariffs on clean energy industries?

The long-term implications of the Trump Administration tariffs on clean energy industries include hindered growth, higher costs for essential materials and components, and potential delays in establishing a self-sufficient domestic supply chain, which is vital for achieving ambitious climate goals.

How do U.S. tariffs on imports influence the global supply chain for clean energy?

U.S. tariffs on imports significantly disrupt the global supply chain for clean energy by increasing costs for necessary components sourced from other countries. This not only impacts domestic manufacturers but also affects global market dynamics, which could slow the transition to cleaner energy solutions.

| Aspect | Impact |

|---|---|

| Overall Tariffs | April 2, 2023, tariffs introduce 10% on all imports, affecting global markets and U.S. consumers. |

| Batteries | Up to 80% tariff on battery imports could hinder anticipated growth in battery storage. |

| Electric Vehicles | 100% tariff on Chinese EVs threatens production; U.S. auto industry suffers due to reliance on imported parts. |

| Solar Power | High tariffs on solar imports could lead to a shortage in supply, despite developers hoarding panels. |

| Fossil Fuels | Tariffs increase costs for energy inputs, impacting prices in states dependent on Canadian energy. |

Summary

The Trump Administration tariffs introduced in 2023 have significantly altered the landscape for various industries, particularly in clean energy. While the intent was to bolster domestic production, these tariffs on imported goods are likely to raise costs for both consumers and companies reliant on foreign materials. As industries struggle to adapt, the long-term implications could hinder progress in clean energy adoption and exacerbate the challenges faced by U.S. manufacturers.